In our earlier post tackling the problem of estimating pilot population sizes, we had concluded that aircraft utilization—in this current environment—is a good proxy for airline health:

In a normal environment, aircraft utilization is bound by time-of-day traveler demand patterns and scheduling constraints. In 2022, it appears the limiter on aircraft utilization is pilot availability, with airplanes being idled for lack of pilots.

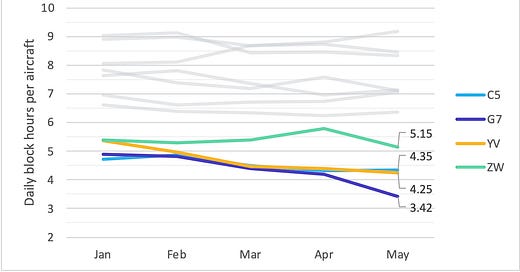

When we calculated March aircraft utilization1 in that post, Mesa, Air Wisconsin, CommutAir and GoJet noticeably lagged their peers.

We went onto hint that this may be an existential indicator. Block hour reductions to accommodate declining regional pilot populations not only put downward pressure on aircraft utilization, but also regional revenues. Meanwhile, some inelastic cost categories, to possibly include aircraft lease and debt commitments, further squeeze economics. As a matter of fact, American in their 2021 Annual Report and United in their 2020 Report disclosed the bankruptcy or cessation of operations of regional carriers as a risk factor. Given the stakes, we think it’s important to contextualize March aircraft utilization—have they bounced, gained support or continue to find new lows?

Our thoughts are with the people of Ukraine, especially the Kyiv-based designer we partnered with this past fall.

We were a bit surprised that airlines’ mileage donation programs haven’t kicked into gear yet, but Miles4Migrants indicates NGO’s haven’t begun to submit requests for displaced Ukrainians. In the interim, they recommend donating to their partners IRC, HIAS, and UNHCR. Alternatively, you can donate to Airbnb’s efforts to house Ukrainian refugees if you wish to stay in the travel sector.

If your experience reading this post is anything like ours writing it, you’ll check Jon Ostrower’s Open Source Intelligence list on Twitter between every sentence. Given the tone on social media, we’ll be doing less self-promotion for the time being—with that said, we’d be particularly appreciative of anybody who shares our writing.

To this end, we need to determine just how far out we can look. As we covered in our first survey of selling schedule changes, schedules from OAG, Cirium, etc. only loosely reflect the airlines’ plans beyond a 90-120 day horizon; moreover, COVID caused that horizon to contract, though airlines have been working to push it back. While selling schedules are maintained on an ongoing basis, there’s typically one “major” update when each month’s2 schedule is cutover to a more realistic facsimile. In the case of American and United, the most recent major load appears to have occurred with the Feb 7 OAG snapshot, when May schedules were substantially updated. Delta is a somewhat confounding case3 and we’re inclined to believe that their selling schedule updates are accomplished in a more incremental, cumulative nature—perhaps a reader in the know can chime in. All that is to say, we think aircraft utilizations are representative of carriers’ anticipated capabilities through the May schedule.

GoJet (G7) has seemingly yet to find a bottom. Otherwise, there’s at least signs of stabilization. Maybe even improvement, if you squint at Air Wisconsin (ZW). While G7’s free fall is no doubt concerning, to be clear, continuing to slog along at an aircraft utilization of 5-ish isn’t a viable path for the others. We maintain our belief that consolidation among regionals—and their pilots, importantly—is likely over the longer term. A number of variables figure to shape what that consolidation looks like:

Let’s start with Mesa (YV), who is an outlier in a couple respects. Most importantly, they operate 70-seat aircraft, which should represent a tailwind; the remaining carriers we’ll consider operate 50-seat aircraft. As United CEO Scott Kirby put it “We don’t have enough pilots to fly all the airplanes. So the 50-seaters are at the bottom of that pile4.” They also fly for both American (contracted through Dec 2025) and United (through 2032—we think); remaining carriers fly for just United. While their gauge advantage bolsters prospects, we should note their pay rates lag, with First Officers starting at $36/hour. Though small print applies across the board, their headline sign-on bonus of $20k is also comparatively low. The pilot contract became amendable in Jul 2021 and it sounds like negotiations are ongoing.

Which brings us to CommutAir (C5), who just announced a new pilot contract yesterday. Starting First Officer rates increased by 30% to $51/hour; they also boast an impressive headline sign-on bonus of $50k, however it’s for reserved for Captains—an important bit of small print. Increased pilot pay should allay pilot attrition, though it may take a few months to flow through to an increase in block hours. While waiting a few months for improvement could otherwise be untenable, there might be a floor underneath CommutAir in the way of United’s 40% stake in the carrier5. And on an at least tangentially-related noted, United extended their capacity purchase agreement (CPA) with C5 in Jul 2020.

GoJet is perhaps the most curious case. They announced increased pilot pay in late December, with First Officers starting at $50/hour. The increase accompanies a $20k sign-on bonus for First Officers (and $65k for Captains). Perhaps that block hours continue to decline is an indication of just how long it takes for increased pay to manifest in increased capabilities. They also occupy a unique spot on the gauge spectrum, flying the CRJ550, an aircraft originally sized to accommodate 70 seats but outfit with 50 seats. The lower seating density provides a strategic benefit to United—and United extended the CPA into 2029 accordingly—but costs are 63% higher6. For as long as business travel’s recovery remains unclear, this cost premium, which is largely passed along to United, may be hard to justify absent an expected revenue premium; it would be reassuring to see the CRJ700 to CRJ550 conversion7 continue (resume?).

Which leaves us with Air Wisconsin. Starting pay for First Officers is a lackluster $38/hour, though the headline sign-on bonus of $45k might pique some interest. Most importantly, the term for the Air Wis CPA ends Feb 2023 and United recently elected not to extend it. The pilot contract becomes amendable in Nov 2022, though it seems more probable that a wind down, not pilot agreement, would be under negotiation by then. If United maintains a similar timeline to that of the May schedule, we should expect a major update to June selling schedules this weekend or next—this should hopefully answer whether April’s util uptick or May’s step-down is the anomaly.

We won’t go so far as to ascribe causation—or even correlation—but will highlight that United’s portfolio of regional carriers participating in their Aviate academy is the same as the four we considered above. Meanwhile, comparatively healthy carriers SkyWest and Republic are absent from the Aviate site; interestingly, Republic is minority owned by United (19% interest) and operate their own training academy (since May 2018). This story is playing out not just in pilot training classrooms but more tangibly in air service to smaller communities. United announced yesterday that they would be ending 17 routes, in what is just the latest round of their cuts (and follows similar suspensions from American and Delta).

While MLK and President’s Day historically provide airlines some relief from the post-holiday doldrums, demand doesn’t really break out until Spring Break travel arrives alongside March. While we’re a little suspicious of the TSA’s weekday mapping for checkpoint numbers8—as best as we can determine—Friday, March 8, 2019 was the first top 100 day by travelers screened (ranking 86th) since the holidays. Moreover, demand continued to pick up, with Friday, March 15 ranking 39th (2.63 million travelers).

2022 looks to follow a similar shape, albeit at lower absolute levels: Spring Break travel should kick off in earnest this weekend, when 183 schools (i.e. colleges and universities) tracked by StudentCity start their recess. Breaks are most concentrated around the third week of March (starting Mar 12), when 397 schools are on recess. We couldn’t find an aggregator of municipal breaks, though some spot checks suggested they’re more evenly distributed (and perhaps reach into April). While we think there’s just a 3% chance that this Friday sets a pandemic record for TSA checkpoint volumes9, we’re more optimistic about the 11th. Despite some tempered expectations vis-à-vis record-setting travel for this Friday, it should be more than enough to write an outlook for—we’ll be back later this week.

Block time from OAG. Fleet counts from Planespotters.net with exception of Mesa and SkyWest, for which latest earnings releases were used.

Schedule periods are not exactly bound by calendar month, though typically start and end within a few days of the calendar month.

For American, May frequencies were down 19.1% versus Jan 31 snapshot; for United, May frequencies were down 14.3% versus Jan 31 snapshot. Delta did not have a week-over-week absolute change in monthly frequencies greater than 3.3%.

Source: November 2021 Skift Aviation Forum

United owns a 40% ownership stake in Champlain Enterprises, LLC, which does business as CommutAir.

Sep 2021 direct operating expense per block hour from DOT’s schedule P-5.2.

In 2021 Annual Report, United lists 11 CRJ700’s as awaiting conversion to CRJ550.

For February, we assume Friday, Feb 25, 2022 corresponds to Friday, Feb 22, 2019. Extending that same mapping across the remainder of the month, Fridays in Feb 2019 were the lightest traveled day of week (average of 1.79 million); meanwhile, Wednesdays in Feb 2019 were the most heavily traveled weekday (average of 2.26 million). This ordering strikes us as plainly incorrect. The good news is mapping seems to get back on track in March (Fridays busiest, Tuesdays lightest), so perhaps it was disrupted by the leap year in 2020. We inquired with TSA but have not heard back.

Currently owned by the Sunday after Thanksgiving 2021 (2.45 million).