First look: MLK weekend go travel

Deicing delays probable in BOS, DEN and MSP even with full complement of deicing trucks... and we wouldn't bet on a full complement (of anything).

Welcome to any new readers — we're grateful that you're here! We're building deep learning algorithms to democratize flight delay predictions; until we launch, we're eager to synthesize things manually in our outlooks. These feature several recurring themes that we recognize may be unfamiliar or intimidating, so we’ve written explainers that tackle airport arrival rates, queuing delays in the airspace and different tools to distribute those delays. If there’s a topic or mechanism you’d like to see unpacked, please let us know (same goes for special travel occasions).

After a few posts that leaned towards Network Planning in their content, we’re back to some more regularly scheduled, operational programming. We’ll be focused on Friday, January 14, as travelers presumably head out for the long weekend. To that end, the first question we had to ask was whether Omicron had dented demand so much that this outlook would land in uninterested inboxes. The answer, surprisingly, is apparently not—while COVID certainly continues to depress passenger volumes, Omicron specifically doesn’t look to have grossly exaggerated the typical post-holiday drop-off in demand.

We indexed TSA checkpoint numbers to the first Monday of the year for 2022, 2021 (influenced by a surge of its own1) and 2020 (virtually uninfluenced by COVID2). One week and a day into this year’s January lull, volumes have averaged 77.7% of throughput from Monday, January 3, 2022, which is sandwiched between last year’s 67.1% (indexed to Monday, Jan. 4, 2021) and pre-pandemic’s 86.4% (indexed to Monday, Jan. 6, 2020). It’s a bit difficult to determine if the “lead” over last year is narrowing or is a product of weekday, so we forecasted both. As something resembling an upper bound to our traveler predictions, if the 6.9 percentage point lead over 2021 from last Friday carries forward, we’d expect checkpoint numbers to equal about 90.5% of Jan. 3 (or 1.73 million); for a lower bound of sorts, we assumed that the gap shrinks to 4.9 percentage points by this Friday, which would yield throughput equal to 88.5% of Jan. 3 (or 1.69 million).

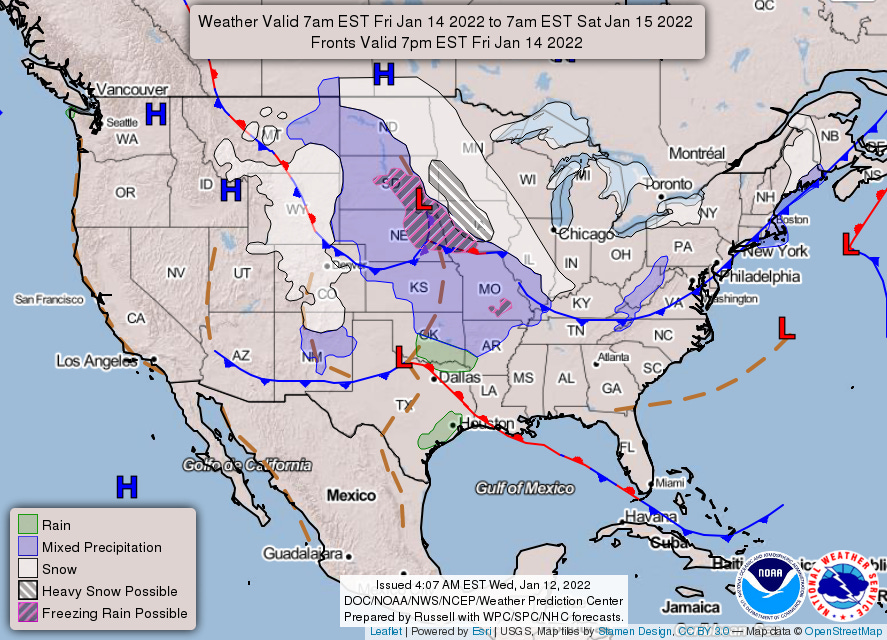

The second question we had to ask was if the forecast chart featured enough weather that we’d have a few airports to write about. While not the broad swaths of the country previous outlooks have tackled, there’s a few hubs we think deserve a peek: Denver (DEN), Minneapolis-St. Paul (MSP) and Boston (BOS).

Denver (DEN)

A quick-moving, elongated area of low pressure—accompanied by a cold front—will cross the area late Thursday through the day on Friday. Moisture is limited, however, and chances for snow top out around 20% during Friday afternoon and evening. Northerly winds will also become fairly strong behind the cold front, though this direction is conducive to DEN’s runway complex. Even at the high end of accumulation forecasts (less than 2” by 11 p.m.), we don’t anticipate snow removal efforts will impair airport capacity. We think 72 is a reasonable arrival rate floor (less than 1 in 10 chance for lower rates), which produces just one potential demand overage. Scheduled arrival demand3 peaks at 84 in the 10 a.m. hour—it looks like ceilings hold up through mid-morning (in which case an arrival rate of at least 96 is a safe bet), however we’ll await a more refined forecast before we cross it off our To Monitor list. Otherwise, even a 72 rate should be sufficient capacity to largely quash air traffic delays for the remainder of the day (next tallest arrival demand peak is 70, in the 4 p.m. hour).

If you’re looking for delays in DEN, your best bet would be departures during the 5 and 7 p.m. banks—even if accumulations aren’t impressive, any falling snow will require a spray from deicing teams. For readers curious about how deicing fits into winter operations, we’ve also got an explainer for that (though don’t anticipate DEN will be on the type of knife’s edge depicted therein).

Unfortunately, deicing introduces one more process that needs to be staffed, which is a precarious proposition at the moment. Whether deicing trucks are staffed by drawing from the baggage handler population or from a separate vendor population, it seems improbable that there will be a full complement. And that’s probably the most important takeaway for DEN: with outages approaching 1/3 of planned staffing levels in some cases4, a perceptible sluggishness figures to prevail this weekend. We typically offer a disclaimer that our efforts are aimed at diagnosing air traffic delays (i.e. those that result from an imbalance between capacity and demand) and that delays owing to aircraft servicing, airline staffing, network effects, etc. are always lurking—more so than any other outlook we’ve written, travelers would do well to adjust their expectations for pervasive non-air traffic delay. Perhaps a missing gate agent prevents you from boarding on-time; or maybe the absence of wing walkers will stop you just short of your arrival gate; or it may manifest itself as a particularly lengthy queue for deicing.

Regardless of how staffing issues reveal themselves, this theme is applicable across the country. While cases are increasing the fastest in Colorado of the states we’ll consider5, you’re unlikely to transit an airport immune from Omicron’s influences on Friday.

Minneapolis-St. Paul (MSP)

A strengthening storm system emerging out of the Central Rockies will work in from the west, with snow expected to commence by noon. Uncertainty around snow totals is higher than we’d prefer, with a spread of underneath 2” to upwards of 6”. Snow removal should exert negligible pressure on airport capacity at the lower end of accumulations, though runway closures for treatment would have to be considered at the higher end. For the moment we’ll set the arrival rate floor at 50 (1 in 8 chance), though our confidence will remain low until certainty increases around snow totals. Schedule arrival demand peaks at 41 (in the 2 p.m. hour), so unless accumulations trend towards the higher end of forecasts, we wouldn’t anticipate air traffic delays. Like DEN, deicing delays for departures should be expected while snow is falling; unlike DEN, there’s less room for optimism that snow may not fall (probabilities exceed 60%). We’d especially watch the 3 and 6 p.m. hours (47 and 32 scheduled departures, respectively) for deicing queues to form.

Boston (BOS)

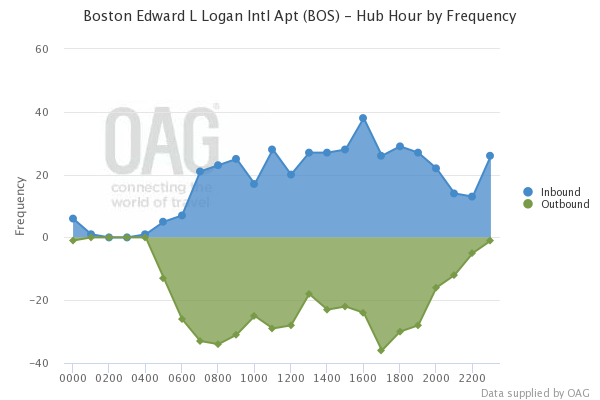

A rapidly intensifying offshore low will deliver a glancing blow to eastern Massachusetts. Mild temperatures to start the day will result in rain at the onset of precipitation, however much colder air filters in by Friday afternoon and a changeover to snow is expected. The Boston Weather Service Office puts high end accumulations around 1”, however short-range ensemble guidance hints at higher amounts (its mean is 1.8” and 6 of the 24 members are greater than or equal to 4”). In the absence of better agreement, here too our confidence is lower than we’d like. Nevertheless, we’ll pencil in 28 for an arrival rate floor (1 in 20 chance for lower rates). Scheduled arrival demand spends much of the day between 27-29, though briefly jumps to 38 in the 4 p.m. hour. Given little recovery room in the 5 p.m. hour, if a 28 rate is realized by late afternoon, we’d wager the FAA reaches for a ground delay program (rather than ground stop) to manage the overage. In terms of deicing delays for departures, outbound demand will be highest during the 5 p.m. hour, though it’s slow to recede thereafter.

We’ll be back tomorrow, when—at a minimum—we should have the benefit of a more granular forecast for mid-morning ceilings in DEN. We also hope the spread in snow totals for MSP and BOS will have shrunk by then. In the meantime, we’ll work on some average delay length predictions. While we still have an update to write for Friday travel, we should also mention the potential for impactful wintry weather as far south as Atlanta (ATL) that may disrupt return travel.

The CDC would not start screening passengers arriving from China until January 17, 2020 (Friday before MLK Day); first US case was confirmed on January 20, 2020 (Monday, MLK Day).

Cargo airlines as well as private jets are not included in scheduled demand and only become apparent when they file a flight plan (generally day-of). This unforeseen demand introduces the risk that delay probabilities are under-forecast.

In a note to employees on Jan. 10, United CEO Scott Kirby wrote, “Just as an example, in one day alone at Newark, nearly one-third of our workforce called out sick.”

Colorado +247% in last 14 days, Massachusetts +223% and Minnesota +194%. Source: New York Times