First look: President's Day go travel

How does ORD recover from Thursday snow? Are EWR arrivals pushed to Runway 29?

Welcome to any new readers—we're grateful that you're here! We're building deep learning algorithms to democratize flight delay predictions; until we launch, we're eager to synthesize things manually in our outlooks. These feature several recurring themes that we recognize may be unfamiliar or intimidating, so we’ve written explainers that tackle airport arrival rates, queuing delays in the airspace and different tools to distribute those delays. If there’s a topic or mechanism you’d like to see unpacked, please let us know (same goes for special travel occasions).

President’s Day concludes a historically quiet period for air travel and Omicron undoubtedly further dampened demand this year. The TSA screened 2.02 million travelers on Sunday, January 2 then hasn’t reached the 2 million-mark since. Thankfully, with Omicron receding (the national 7-day moving average of new cases is down 75% from mid-January peak1), we’re betting TSA throughput will again surpass 2 million on Friday, if not Thursday. A bit more specifically, we built a forecast that considers both trend and day-of-week patterns2; while it doesn’t account for holidays, we can use forecast errors from MLK weekend as a proxy. For the Friday ahead of MLK Day, actual checkpoint volumes were 2.5 standard deviations above our forecast: if we apply that same forecast error to this Friday’s forecast, we arrive at an estimated 2.20 million travelers. Moreover, some back-of-the-napkin forecasting points to higher volumes. Coupled with demand related to NYC schools’ midwinter recess (the Nation’s largest school district, with 1.1 million students) and the Daytona 500 (attendance could reach 150,000), we’d probably take the over on 2.20 million screened. We’ll also leave the Pandemic high-water mark of 2.45 million travelers (from Sunday after Thanksgiving 2021) here.

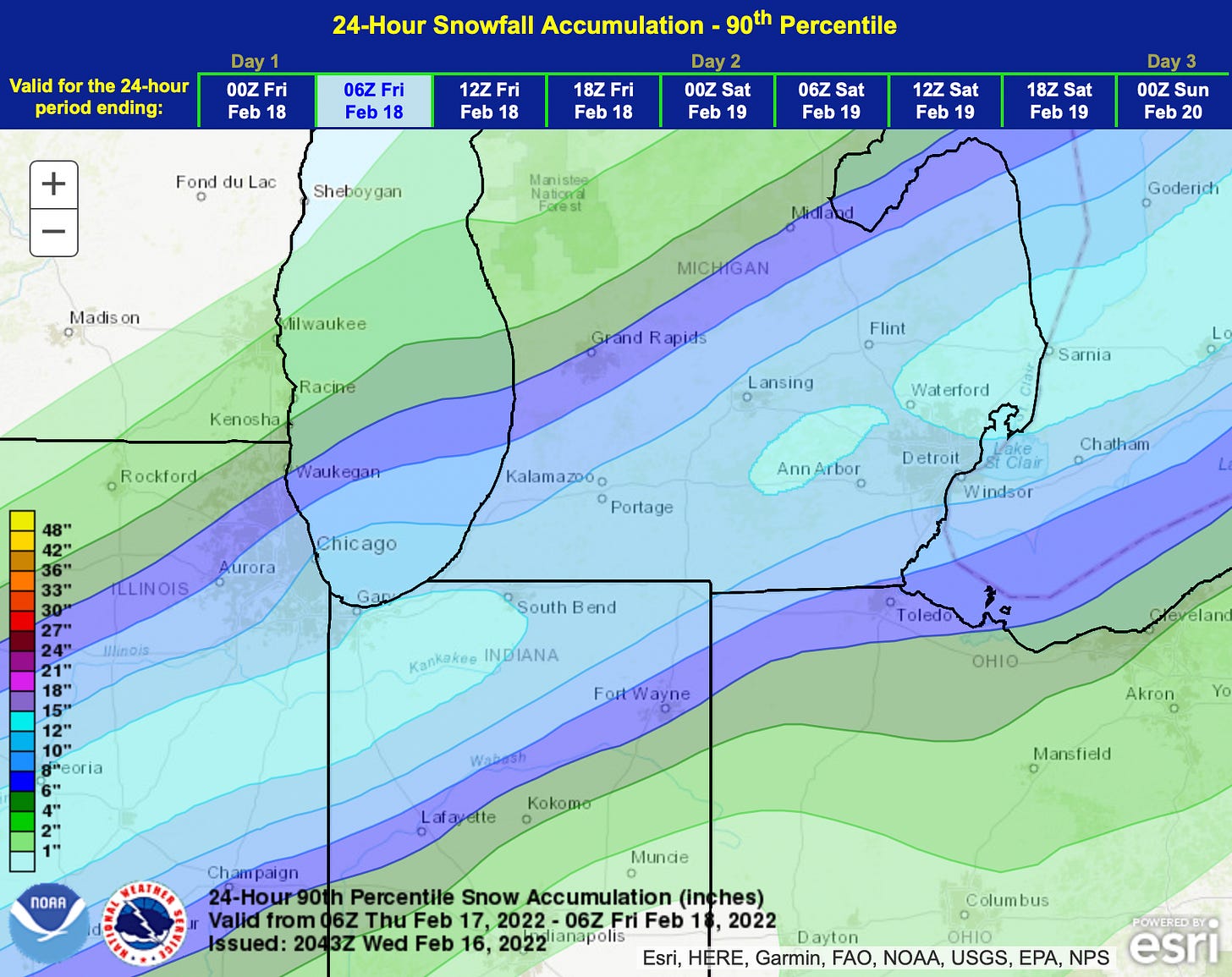

So what’s in store for these passengers on Friday? Perhaps more than any other outlook we’ve written, outcomes will be determined early in the day (maybe even Thursday night). An area of low pressure is forecast to develop over the Texas Panhandle Thursday morning then track northeastward along its associated cold front. Warm and moist air ahead of the cold front will set the stage for possibly severe thunderstorms for the Appalachians and Southeast Thursday night. On the cold side of the system, a swath of potentially heavy snow is possible for the southern Great Lakes. The system exits the East Coast early Friday.

Great Lakes

Let’s start our survey in Chicago, as how O’Hare (ORD) is able to spool-up on Friday—emerging from Thursday’s winter operations—may exert the most leverage over travelers’ itineraries. Guidance has shifted the heaviest snowfall to ORD’s south, though 4-6” still looks likely (and 8-10” possible at the high-end). While snow is forecast to end by midnight, blowing snow will likely hamper efforts to clean-up the airfield overnight into Friday morning. It appears airlines are inputting schedule reductions as we write: with these figuring to reach into Friday morning, it’s difficult to speculate on what demand will look like until cancellations settle out. For the moment, we’ll note 88 arrivals are scheduled3 in the 7 a.m. hour and 104 departures in the 8 a.m hour. With respect to capacity, we like 84 as an arrival rate floor4. We do want mention a southerly component to winds during the midday, though unless they back further than the 210° currently forecast, we’d expect ORD to hang onto a west flow.

While ORD is on the northern edge of highest snowfall amounts, Detroit (DTW) looks to duck to the south of heaviest snow. Nonetheless, slightly higher amounts are favored for DTW (8” short-range ensemble mean) and snow ends slightly later (though still pre-dawn). Despite a slightly more challenging set-up, there’s less question as to whether or not a demand overage materializes: morning scheduled demand peaks as 37 (in the 11 a.m. hour) and we struggle to envision an arrival rate less than 48.

Southeast

Unless the timing of thunderstorms slows down, Atlanta (ATL) and Charlotte (CLT) should escape without air traffic delays5. In the absence of thunderstorms, we’d put ATL’s arrival rate floor at 116 (less than 1 in 10 chance for lower rates) and morning scheduled demand peaks at 81 (8 a.m. hour). For CLT, we think 80 is a reasonable arrival rate floor (less than 1 in 20 chance for lower rates) and morning scheduled demand peaks at 57 (8 a.m. hour). The frontal passage is currently forecast to occur before sunrise; if this timing slides right, then lightning could produce an inopportune ramp closure6 or trigger a ground stop.

Mid-Atlantic & Northeast

As we head north, there’s less risk for convection, with the Washington/Baltimore NWS office not even mentioning thunder in their discussion. While there will be some gusty northwest winds to contend with, the region looks to have found a precipitation type/intensity sweet spot—the mention of snow is also omitted from forecast discussions (at least as it relates to this departing system on Friday). Moreover, demand is generally backloaded at these airports and conditions are forecast to improve as the day goes on. So, with a few tailwinds, let’s take a quick tour through demand/capacity specifics:

Scheduled demand peaks at Washington-Reagan (DCA) at 33 (4 p.m. hour), which should be accommodated by our arrival rate floor of 36 (less than 1 in 10 chance for lower rates).

We’d put an arrival rate floor underneath Washington-Dulles’ (IAD) at 72 (less than 1 in 10 chance for lower rates) and peak scheduled demand falls short of it (58 in the 9 a.m. hour).

We’ll need to keep an eye on Philadelphia (PHL), where scheduled demand peaks at 46 (6 p.m. hour), however we’ve set our arrival rate floor at 40 (1 in 10 chance for lower rates).

Northwest winds are likely most consequential at Newark (EWR), where they could push arrivals to Runway 29, resulting in arrival rates less than 40 (1 in 8 chance). Scheduled demand peaks at 45 (7 p.m. hour).

Scheduled demand at New York-Kennedy (JFK) peaks at 41, however we think 44 is a serviceable arrival rate floor (less than 1 in 10 for lower rates).

New York-LaGuardia (LGA) is an interesting case with respect to capacity. We estimate chances are less than 1 in 20 for rates lower than 30, but nearly 1 in 6 for a rate equal to 30. This is against the backdrop of maximum hourly demand of 36.

We round out our review in Boston (BOS), where demand peaks at 36 (4 p.m.). While we tried to talk ourselves into an equal arrival rate floor, we landed on 34 (less than 1 in 10 chance for lower rates).

We’ll be back with an update tomorrow, when the ORD schedule reduction should have [hopefully] settled out. We’ll also have refined forecasts in hand for PHL, EWR and LGA. In the meantime, we’ll start in on some average delay length predictions.

Source: New York Times, Covid in the U.S.

Multiplicative Holt-Winters

Cargo airlines as well as private jets are not included in scheduled demand and only become apparent when they file a flight plan (generally day-of). This unforeseen demand introduces the risk that delay probabilities are under-forecast.

We set this floor having looked at January 24th, when ORD’s start up took place against the backdrop of overnight snow (though in this case, it lingered into mid-morning): they had returned to an 84-rate 8 hours after snow ended.

Our efforts are aimed at diagnosing air traffic delays. Though not the focus of our efforts (yet), delays owing to aircraft servicing, airline staffing, network effects, etc. are always lurking.

Employees who work outside (e.g. baggage handlers, fuelers) are pulled off the ramp when lightning is in the area, which halts aircraft turnarounds.