First look: Sunday Jan. 2 travel

But first, an update on tomorrow's snow event at Chicago O'Hare

Welcome to any new readers — we're grateful that you're here! We're building deep learning algorithms to democratize flight delay predictions; until we launch, we're eager to synthesize things manually in our outlooks. These feature several recurring themes that we recognize may be unfamiliar or intimidating, so we’ve written explainers that tackle airport arrival rates, queuing delays in the airspace and different tools to distribute those delays. If there’s a topic or mechanism you’d like to see unpacked, please let us know (same goes for special travel occasions).

Saturday snow at Chicago O’Hare (ORD)

Before we get into Sunday, which should be the more heavily traveled day, we wanted to touch on winter weather set to affect ORD tomorrow. Given the narrower geographic impact, we elected to try something a bit different and covered this event via a couple Twitter threads.

Confidence is increasing for at least 6” of snow to fall from midday Saturday through Saturday night; snowfall rates may exceed 1” per hour during afternoon. Airlines have responded with a significant schedule reduction, having already canceled 54% of the scheduled departures tomorrow (as of 9:00 p.m. ET). American Airlines and United Airlines, who both operate hubs at ORD, have issued travel alerts that waive any fare difference (as well as the rare change fee).

Sunday’s backdrop

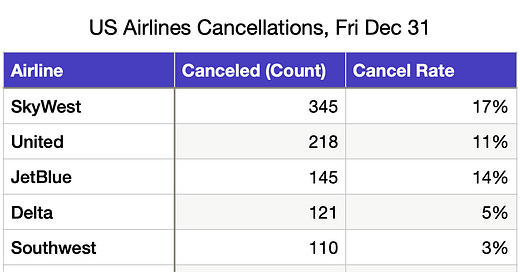

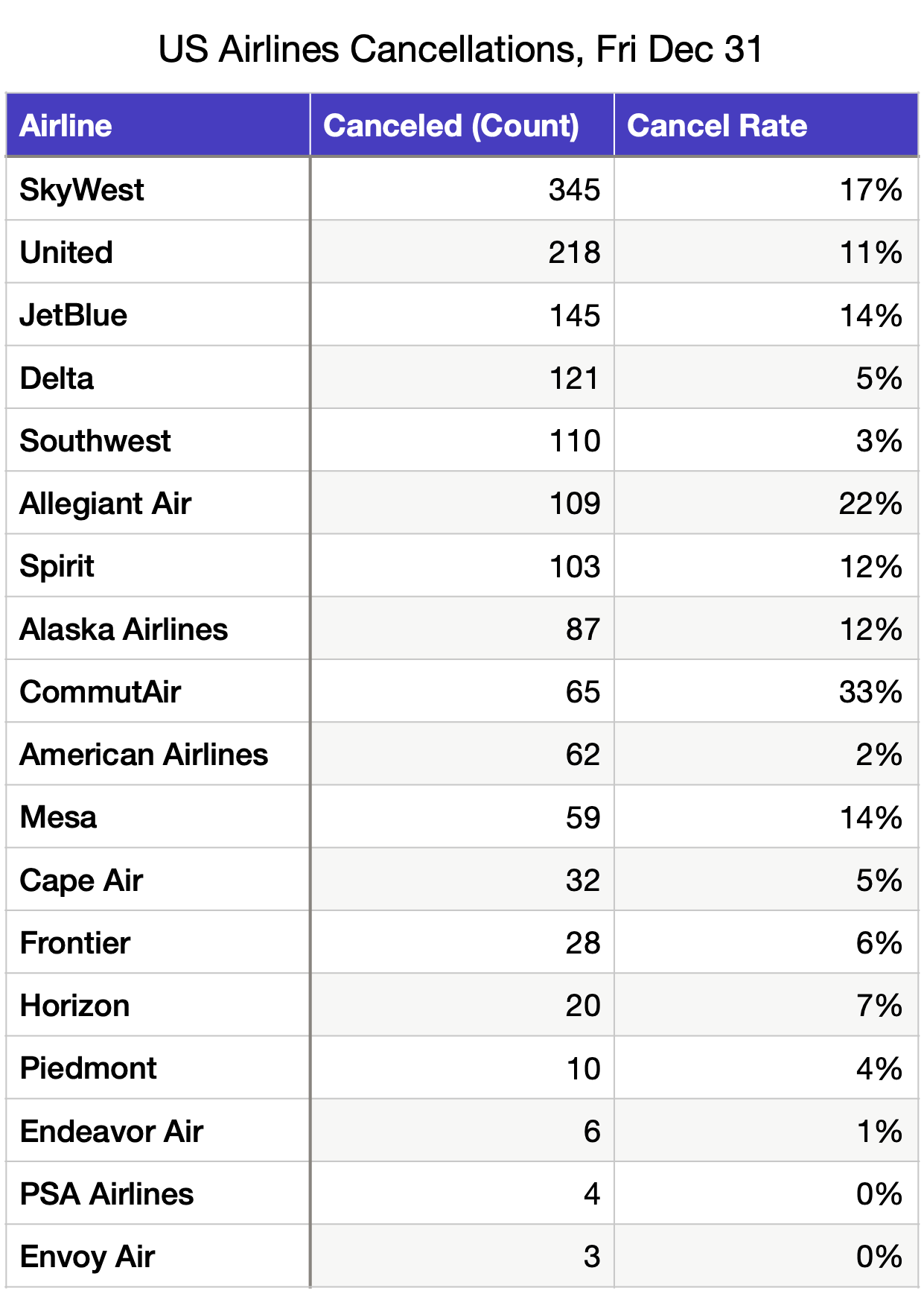

While not as acute as late last week, cancellations have remained stubbornly high, with winter weather complicating airlines’ efforts to wrestle Omicron-related crew outages. Regional carrier Skywest again finds themselves atop today’s cancellation laggard board, though we should note they’ve been disproportionately impacted by snow in the Pacific Northwest and, more recently, Mountain West. Cancels at United1, where things got kicked off last Friday, have ebbed back up and trips that include a Boeing 737 remain a particularly risky bet (cancellation rate about 11 percentage points higher than other fleets). For its part, JetBlue has announced they’ll be adjusting schedules through January 13th—we’re anxious to see how much of this is accomplished with tonight’s selling schedule load, which would reduce the type of cancellations tracked by sites like FlightAware.

Passengers have been apparently less inclined to hit the cancel button, with TSA checkpoint volumes exceeding 2 million travelers on four of the last five days. Sunday figures to be one of the busier air travel days of the year-end holiday period, ranking 4th in capacity2. If recent trends hold, we’d expect the TSA to screen between 2.09 and 2.17 million travelers—so what’s in store for them? An area of cold high pressure will be pushing southeast into the Midwest and Southern Plains. Moisture will pool along a frontal boundary at the leading edge of cool air: snow may mix with rain for the Mid Atlantic and Northeast while thunderstorms are possible for the Southeast. Meanwhile a front will be coming onshore over the Pacific Northwest.

Airport capacity and demand

Given that such a broad swath of the country could see impacts on Sunday, we’ll attempt to spend no more than a couple sentences on each airport today then hopefully return with a narrowed focus tomorrow. Before we dive in, we’ll qualify that our efforts are aimed at diagnosing air traffic delays—though not the focus of our efforts (yet), delays owing to aircraft servicing, airline staffing, network effects, etc. are always lurking.

We’ll sort things out alphabetically (by airport code), which means we start with Atlanta (ATL). We’d set the arrival rate floor at 96 (though think there’s at least 1 in 5 chance for it to be hit). Scheduled arrival demand peaks at 76 (in the 3 p.m. hour), so we don’t expect any ground stops or ground delay programs. Thunderstorms may constrain arrival and depart fix capacities, which could produce airborne holding for arrivals or taxi-out delays for departures.

We think 34 is a serviceable arrival rate floor at Boston (BOS), with chances less than 1 in 20 for lower arrival rates. Scheduled arrival demand just so happens to peak at 34 (in the 4 p.m. and 5 p.m. hours), so air traffic delays should be negligible3.

There’s about a 1 in 10 chance for an arrival rate in the 68-70 range at Charlotte (CLT). This would be notable in the 8 a.m. hour (73 scheduled arrivals) and a bit more problematic in the 9 p.m. hour (79). There’s also a wind direction shift during the evening that will likely drive a runway change—as they turn the airport around, they’re liable to lose a few landing slots. And like ATL, thunderstorms may constrain fix capacities. We’ll be revisiting CLT tomorrow.

We estimate there’s at least a 1 in 6 chance for reduced arrival rates in the range of 28-30 at Washington-Reagan (DCA). Demand peaks at 29 (in the 9 p.m. hour) however, so air traffic delays should virtually zero.

Ah, Aerology outlook mainstay Newark (EWR). We think there’s a 1 in 8 chance that the arrival rate falls to 32 or lower (and about 1 in 5 to fall to 36 or lower). Scheduled arrival demand for much of the afternoon and evening is at or above 33, including a peak of 48. We’ll also need to keep an eye on wind strength as direction veers to the northwest during the evening—arrivals primarily utilizing Runway 29 would introduce additional complications. Needless to say, we’ll be revisiting EWR tomorrow.

A 64 arrival rate is a safe bet for a floor at Washington-Dulles (IAD), with only a 1 in 50 chance for lower rates. Scheduled arrival demand peaks at 63 in the 9 a.m. hour, so air traffic delays should be negligible provided unscheduled traffic does not also cluster around 9 a.m.

We think there’s less than a 6% chance for arrival rates at New York-Kennedy (JFK) to fall below 40. Scheduled arrival demand peaks at 40 (in the 9 p.m. hour), so air traffic delays for arrivals should be negligible. On the departure side, we’ll highlight the 8 a.m. hour, when an impressive 60 departures are scheduled—due to sheer volume, we’d expect some longer taxi-outs.

A few miles away at New York-LaGuardia (LGA), we wouldn’t discount a 30 arrival rate (1 in 10 chance). We’ll be revisiting LGA tomorrow, as demand for much of the afternoon and evening is at or above 33 (though conditions are forecast to improve as the day wears on).

Our last stop on the East Coast will be Philadelphia (PHL). 32 looks to be a reasonable, if not unlikely floor (1 in 6 chance). Scheduled arrival demand peaks at 48 in the 8 a.m. hour (with another, only slightly shorter, peak in the 6 p.m. hour), so we’ll keep PHL on the list for tomorrow.

We’ll round out things in Seattle (SEA). Temperatures will finally start to warm on Sunday, so this should mercifully be a rain event. Nonetheless, ceilings are still liable to reduce capacity and we’d put chances at almost 1 in 2 for a 40 arrival rate. Most notably, the 10 a.m. hour features 46 scheduled arrivals, so we’ll be taking a look at SEA tomorrow.

Where does that leave us? Fortunately, travelers on Sunday don’t look to face any level of disruption similar to what’s on deck for ORD tomorrow. That said, it’s tough to envision EWR gets out of the day totally unscathed; we can muster some optimism for the other airports still on our list. We’ll be back tomorrow with average delay length predictions for CLT, EWR, LGA, PHL and SEA. Happy New Year’s!

United Mainline. American, Delta and United operate their own flights, considered their Mainline operation (on larger jets, with upwards of 100 seats). These airlines also “purchase capacity” from regional carriers (e.g. SkyWest), wherein the regional carrier operates smaller aircraft (i.e. less than 100 seats) under the Mainline brand.

Measured by domestic seats for 12/16/21-1/3/22. Monday actually ranks 2nd, though weather looks relatively cooperative and we wouldn’t have much to write about

Cargo airlines as well as private jets are not included in scheduled demand and only become apparent when they file a flight plan (generally day-of). This unforeseen demand introduces the risk that delay probabilities are under-forecast. Unscheduled demand added 9.6% to scheduled demand for Core 30 airports between 11/15/2021-12/14/2021. For the airports we’ll consider today, IAD (20.1% added) and PHL (17.7%) are above average in this regard; unscheduled activity added 9.6% at BOS.