First Look: Thursday, Dec. 23 travel

Impacts from strong Pacific storm reach east to Rockies; plus, we're featured.

Welcome to any new readers — we're grateful that you're here! We're building deep learning algorithms to democratize flight delay predictions; until we launch, we're eager to synthesize things manually in our outlooks. These feature several recurring themes that we recognize may be unfamiliar or intimidating, so we’ve written explainers that tackle airport arrival rates, queuing delays in the airspace and different tools to distribute those delays. If there’s a topic or mechanism you’d like to see unpacked, please let us know (same goes for special travel occasions).

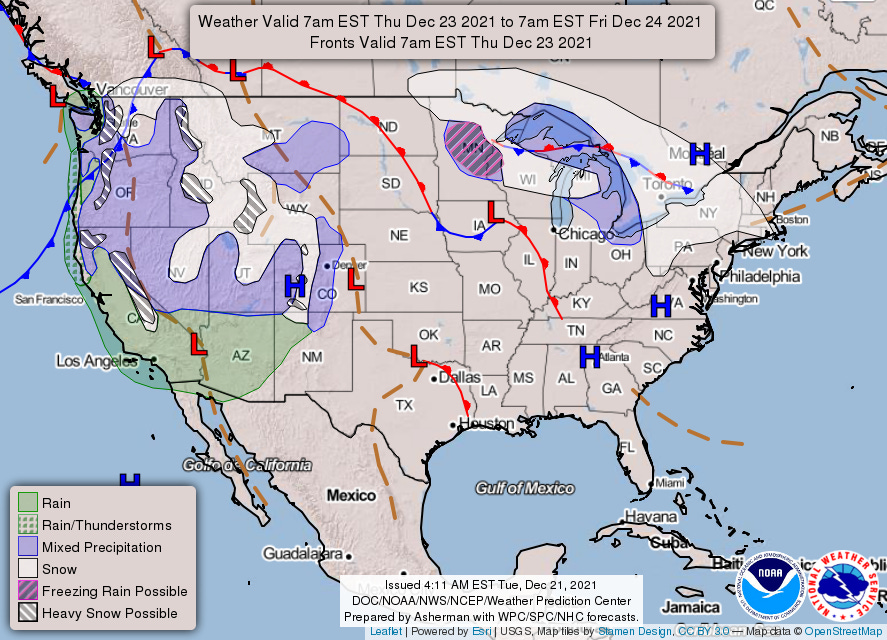

Traveler volumes have largely held up against cooling influences from Omicron, with the TSA having screened at least 2 million passengers on each of the last 5 days. This Thursday features the most capacity1 of the year-end holiday period and we’re curious how many travelers will be in the system. If TSA checkpoint numbers come in towards the busier end of our expectations, 2.38 million passengers is conceivable and would represent a 100% increase year-over-year. We’ll also mention 2.46 million, though we’d bet against reaching it — that would set a pandemic record, which currently belongs to the Sunday after Thanksgiving. For many travelers, wet and unsettled weather for West Coast airports is set to play a part in their journey on Thursday. Moisture first reaches Northern California today ahead of an offshore cold front, while the front’s parent low pressure digs down the British Columbia coast. As moisture eventually surges into the Pacific Northwest, terrain enhancement will allow precipitation to extend into the Rockies.

We also want to highlight one non-weather theme that’s likely to play a part in outcomes at all airports: Omicron’s influence on already-lean airline staffing levels. Case counts among airline employees are no doubt following the country’s upward trend and, needless to say, an employee who tests positive is expected to stay home. Unfortunately, because airline employees often work in small teams, one positive case can have a multiplicative effect, wherein their close contacts are required to quarantine. Rising case counts also seem likely to produce more closures of FAA facilities (to allow for cleaning), though impacts should mostly be confined to overnight periods.

Pacific Northwest

We’ll start off in Seattle (SEA), where most guidance indicates temperatures will remain warm enough through Thursday for plain rain in the lowlands. We’ll note the short-range ensemble forecast (SREF), however, which is an outlier model and includes some low probabilities (i.e. 10-15%) for snow later in the day. We’ll keep an eye precipitation type, but for the moment assume it’s all rain for SEA on Thursday. Still, plain rain — and attendant low clouds — looks to be enough for some delays in the 10 a.m. hour, when scheduled demand2 peaks at 48 arrivals. We think chances are less than 1 in 5 that SEA delivers an arrival rate of 48 or better necessary to avoid a demand overage. Things are a little more marginal later in the day, when arrival demand is between 42-44 in the 2, 6 and 8 p.m. hours. Thankfully, downside in these later cases is buoyed by an arrival rate floor of 40 (less than 2% chance for lower rates), though we wouldn’t bet against some minor delays (6% chance for 40 arrival rate, 26% chance for 42 arrival rate). We’ll keep SEA on our list to revisit in tomorrow’s update.

California

Wind direction will be the most important variable in San Francisco (SFO). Winds are forecast to stay out of the south through mid-morning on Thursday, which threatens to push arrivals from the 28’s to 19’s. We’d put chances at nearly 1 in 2 for this suboptimal runway configuration to occur and an arrival rate of 28 should be expected if it verifies. The 9 a.m. hour seems riskiest, when 32 arrivals are scheduled. Winds start to veer to a more westerly direction (and diminish) midday, which should permit a 36 arrival rate — we’ll be watching this timing closely, given that SFO’s arrival demand peaks in the noon hour (at 36). If the timing for this shift is delayed in subsequent forecasts, we wouldn’t be surprised to see a GDP issued Thursday morning; if there’s optimism that arrivals will be able to utilize Runway 28 by noon, we’d expect the FAA to take a wait-and-see approach then use ground stops as needed.

There’s some uncertainty as to how far south the moisture plume pushes and Los Angeles (LAX) may remain dry if current trend continues. Thankfully, LAX is a relatively easy case regardless of shower coverage: their arrival rate floor is 58 and demand peaks at “only” 50. In the absence of any capacity/demand imbalance, we predict no air traffic delays at LAX on Thursday. As always, delays owing to aircraft servicing, airline staffing, network effects, etc. can (read: will) occur.

Rockies and Great Basin

Moisture begins streaming into Salt Lake City (SLC) later in the day on Thursday. There’s a mismatch between coldest temperatures (to start the day) and highest probabilities of precipitation (later in the day). Guidance suggests a wintry mix is possible during the morning before a transition to plain rain by afternoon; again, the SREF is an outlier, calling for increasing probabilities for snow as the day wears on (reaching 20-25%). Like SEA, we’ll trust the consensus and assume a change over to all rain occurs, though we’ll be keeping an eye precipitation type. Deicing delays for departures should be expected if snow mixes in with rain during the morning, though accumulations look to be negligible and we don’t anticipate any impacts to airport capacity resulting from snow removal. If deicing and snow removal are foreign concepts, we’d encourage you to check out our winter operations explainer below. In the absence of snow removal, SLC’s arrival rate floor should be 60 on Thursday, which would comfortably accommodate the arrival peak of 36. Unless SREF’s precipitation type forecast verifies and snow accumulations overachieve, we forecast no air traffic delays at SLC.

The Sierras intercept much of the moisture before it reaches Las Vegas (LAS). Even if LAS remains dry, however, some low- to mid-level clouds are forecast to fill in, which would pressure airport capacity. We’ll anxiously await refined ceiling forecasts, as there’s currently a range of about 5,000’ and probabilities for reduced arrival rates are considerably more worrisome (about 3 in 10) at the low end of the range than high (virtually zero). Blended probability across the range for a 32 arrival rate is about 7%, which would be most problematic during the noon hour, when 37 arrivals are scheduled. We’ll also need to monitor how unscheduled demand takes shape — while LAS is typically above-average in terms of private jet and cargo airline activity, day of week patterns around Christmas warrant further examination (it’s on our to-do list for tomorrow).

Precipitation doesn’t quite reach Denver (DEN), though light snow is expected to start across its nearby mountains during the afternoon. Impacts to Aspen (ASE) and Vail (EGE) are possible, however the absence of historical data (both capacity and demand) for these airports seriously inhibit our forecasting efforts. Unfortunately, the mention of a possible GDP is about the best we can do when it comes to prognosticating these ski airports. We will note that the heaviest snow is not forecast until Friday.

Edge Cases

Timing for rain to start at Phoenix (PHX) continues to be pushed back (into late Thursday night), though cloud cover is already streaming into the region and will linger through the weekend. We think a 48 rate is a reasonable worst case scenario (about 1 in 10 chance), which would largely accommodate peak demand (48 scheduled arrivals in the 7 p.m. hour).

While most of our attention has been focused on the Pacific storm system, there will also be a disturbance tracking across the Upper Midwest. It produces a somewhat scary-looking hatched area on the map in the vicinity of Minneapolis-St. Paul (MSP), though chances for precipitation are confined to areas east of the airport. Snow is more likely at Detroit (DTW), though accumulations should stay underneath 1/4 inch. While deicing delays are probable, snow removal efforts should not be required and we put DTW’s arrival rate floor at 60 (1 in 20 chance for lower rates). Scheduled arrival demand peaks at 42 in the 7 p.m. hour — in the absence of a demand overage, we predict no air traffic delays at DTW on Thursday.

What we’ll be monitoring

Wind forecasts for SFO are at the top of our list, as we watch for any signs of a later shift to a more westerly direction — on the balance, a SFO GDP stretching into early afternoon poses the greatest risk to travelers itineraries on Thursday. We also have some homework surrounding LAS private jet patterns around Christmas. Lastly, we’ll be keeping an eye on precipitation type forecasts at SEA and SLC.

We also want to highlight one non-weather theme that’s likely to play a part in outcomes at all airports: Omicron’s influence on already-lean airline staffing levels.

We aren’t compelled to recommend rebooking at this juncture. Our update tomorrow will feature some more quantitative delay length predictions, though any potential delays in LAS, SEA and SLC don’t look to be showstoppers. In the case of SFO, there’s enough uncertainty that we’d suggest any readers set to transit the airport take a wait-and-see approach.

We were excited to learn that Substack featured our blog on their homepage. It may sound cheesy, but it’s true — we wouldn’t have been selected if it weren’t for our readers, so thank you from the bottom of our hearts. We’ll be spotlighted for the remainder of this week, so if you’ve been thinking about sharing our blog with somebody, now could be an especially good time!

As measured by seats scheduled to depart from US airports

Cargo airlines as well as private jets are not included in scheduled demand and only become apparent when they file a flight plan (generally day-of). This unforeseen demand introduces the risk that delay probabilities are under-forecast. Unscheduled demand added 9.6% to scheduled demand for Core 30 airports between 11/15/2021-12/14/2021. Of the airports we’re considering in this outlook, LAS (15.8%) and SLC (15.0%) were above average by this measure.