Penciling in our summer travel outlooks

Plus verifying our May EDCT forecast, updating June and July

😩. That’s two underwhelming weekends in a row in terms of TSA throughput. In our outlook for travel last Friday, we predicted there was a 42-50% chance to set a new post-February 2020 record—we needed to beat the 2.45 million travelers screened on the Sunday after Thanksgiving 2021. If we’re in the trust tree, we thought that prediction was a bit pessimistic. And then 2.39 million travelers were screened on Friday (landing in the 39th percentile of our Holt-Winters forecast). That’ll teach us to trust the data.

Flight cancellations, of which there were 1,200 on Friday, likely depressed traveler volumes. We estimated there were 137,000 seats1 scrubbed on Friday; not all of these seats were booked and in some cases, passengers would have been screened before their flight cancelled. That said, it seems reasonable to assume that some cancelled passengers switched their mode of transportation or forwent their trip before reaching the airport. Even so, TSA throughput has been stubbornly flat for the last two-plus weeks, with the 7-day moving average trading in a range of 2.20-2.22 million between May 17 and May 26. For their part, both 2019 and 2021 demonstrated a 5-6% run-up in the 10 days leading into Memorial Day weekend.

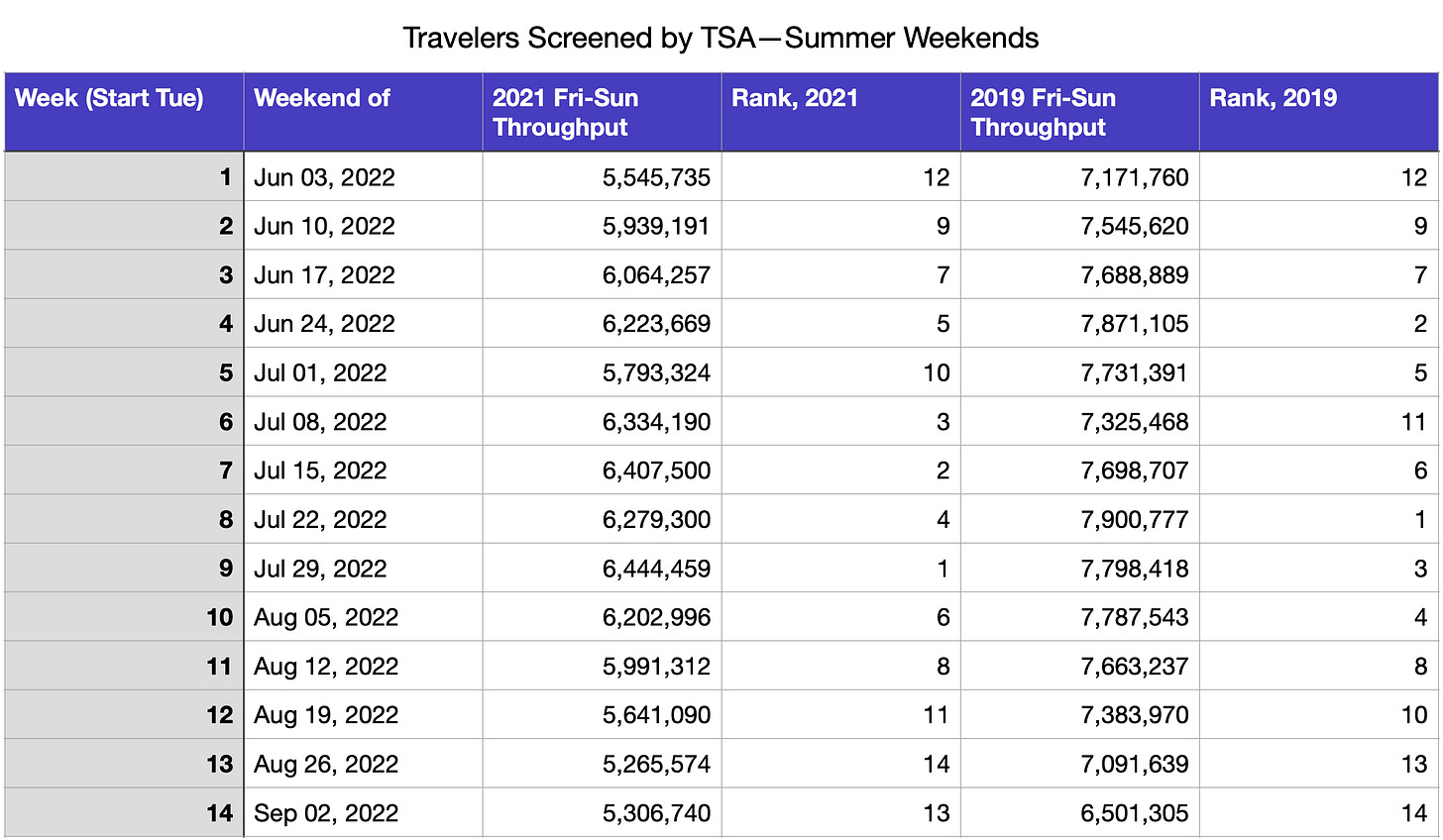

So where does that leave us going forward? We’re in wait-and-see mode. Once we get past the first two weeks of June, improving parallel-ness (parallelity?) in 2019 and 2021 trendlines lends some certainty. July 4th briefly interrupts the tidy 2019-2021 correlation and we’re confident this year will more closely match the directionality of 2021 (when the holiday was observed on Monday2—mimicking this year).

There’s also the matter of dispersion in daily checkpoint volumes (not the smoothed 7-day average) and day-of-week patterns. Summer 2021’s relative standard deviation is 1.8 percentage points greater than 2019, with Fridays and Sundays last year peak-ier than their peers from three years ago (and Tuesday/Wednesdays more shoulder-y). One notable manifestation of this is the frequency at which the Memorial Day Friday checkpoint volume is exceeded during the next 14 weeks before Labor Day. In 2019, 2.79 million travelers were screened on the Friday inaugurating summer travel: It would be beat just once, on the Sunday after July 4th. In 2021, 46 times daily checkpoint volumes exceeded the 1.96 from Friday, May 28, 2021. Here too we’re inclined to think 2022 will follow 2021 patterns. If we beat last Friday just once—and by only 0.1%—we’ll be quite disappointed.

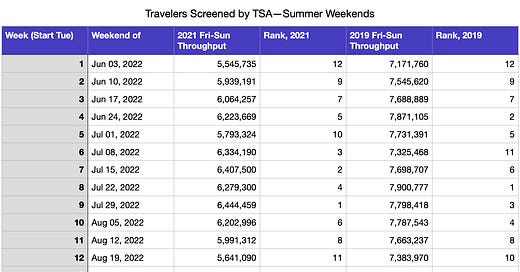

We’re planning to unload one more thematic post next week then resume our outlook series the following weekend [of June 17]. We’re then penciling in an outlook for Friday July, 1—though Sunday depresses the 3-day throughput, that Friday was the 6th busiest day of last summer. We also figure to write outlooks for the weekends of July 22 and July 29, which were the most-traveled weekends in 2019 and 2021, respectively. Labor Day Friday also calls for an outlook, if not for the sake of traveler volumes (it was 7th and 9th busiest of 14 summer Fridays in 2021 and 2019, respectively), then for the sake of symmetry. So that’s 5 outlooks on our calendar; we intend to drop a couple more in there as things take shape (early July and early August make sense).

Summer Air Travel Primer 2.0

In our summer air travel primer, we defined an exponential relationship between air traffic delays and capacity utilization. We primarily aimed our prognosticating at June-August as the title suggested, but we did make some May predictions as long as we were at it. So how did those compare to actuals?

Our inter-quartile range for May air traffic delay incidence3 was 2.97-3.21%. Our forecast was tracking nicely through the first 25 days of the month, when delay incidence stood at 3.06%. Then 10.1% of arrivals were delayed owing to air traffic on the Friday of Memorial Day Weekend—only the fourth such time that more than 10% of a day’s arrivals were assigned an EDCT since COVID’s onset. Moreover, Friday was sandwiched between 2 days with more than 5% of their arrivals delayed by air traffic. Rough finish to the month.

Air traffic delay incidence would settle out at 3.39% for the month of May, good (bad?) for the 94th percentile of our forecast. With the benefit of actual4 May demand and capacity values to plug into our equation, our forecast error was +0.66 percentage points (i.e. predicted air traffic delay with known capacity and demand values was 2.73%). Interestingly, we also predicted air traffic delay intensity (i.e. total minutes of EDCT delays for core 30 arrivals) and, by that measure, May landed in the 24th percentile.

We’re also prompted to update our June-August forecasts on account of revised selling schedules. Delta made headlines by thinning their June (and end-of-May) schedules via cancellations then reducing their selling schedules for July and August. In the 3 intervening OAG snapshots since we initially forecasted summer air traffic delays, Delta reduced July frequencies by 4.7% and August by 3.6%. But Delta wasn't by themselves. The 10 largest marketing carriers (excluding Delta) reduced July and August frequencies by 1.3%, including JetBlue (down 10%) and United (1.3%).

These selling schedules cuts are not a new concept. As a matter of fact, we can borrow from the primer to explain:

Although these reductions have no doubt resulted in some frustrating itinerary changes, they should buoy the operational integrity of the national airspace system (and allow airline leadership to equivocate about summer reliability). Reduced demand serves to depress our capacity utilization measure, which shifts us down along the exponential curve.

In our median estimates, these recent schedule reductions have saved approximately a quarter point of EDCT incidence and nearly 2,500 hours of air traffic delays. A back-of-napkin reproduction of some FAA-sponsored math suggests these cuts were worth $79 million in cost avoidance, including $44 million associated with the value of passengers’ time.

We multiplied cancellations by operating carrier by their average gauge. While this should be quite representative for regional and low cost carriers, it likely overstates cancelled seats for network carriers (i.e. American, Delta and United likely cancelled narrow-bodies at a higher rate than wide-bodies).

Though the 4th fell on Sunday. In 2019, July 4 fell on Thursday.

We used the percentage of arrivals to Core 30 airports assigned an estimated departure clearance time (EDCT) as our measure of delay incidence. EDCTs (often called wheels up times) marshal the queueing that results when demand for an airport’s runway(s) exceed their capacity. If you're curious about the conceptual underpinnings, we’d encourage you to check out our explainers.

Core 30 airports are ATL, BOS, BWI, CLT, DCA, DEN, DFW, DTW, EWR, FLL, HNL, IAD, IAH, JFK, LAS, LAX, LGA, MCO, MDW, MEM, MIA, MSP, ORD, PHL, PHX, SAN, SEA, SFO, SLC, TPA.

In forecasting May (or any other month for that matter), we have a good picture of scheduled demand but need to forecast unscheduled demand. We also attempt to account for the uncertainty in airport capacity by using a range of efficiency arrival rates derived from the standard deviation and average of 2010-2019 values.

Cancellations at the end of the month (nearly 2,900 over the last 4 days) would have distorted the capacity utilization number (by shrinking the numerator) as well as EDCT incidence (many of the cancels would have been assigned an EDCT).