Selling schedule updates: Jan. 15 edition

Alaska relaxes pilot utilization for remainder of January; Hawaiian and American push back Haneda service, Avelo suspends BUR-TUS

No boilerplate needed about explainers for this one, though we still want to welcome new readers—we’re grateful you’re here!

Instead, we’ll use this space to solicit suggestions: with the holiday travel season having wrapped up, we’re on the lookout for future travel occasions we can cover. Please drop any suggestions in the comments (we’re quite happy to write about more localized events).

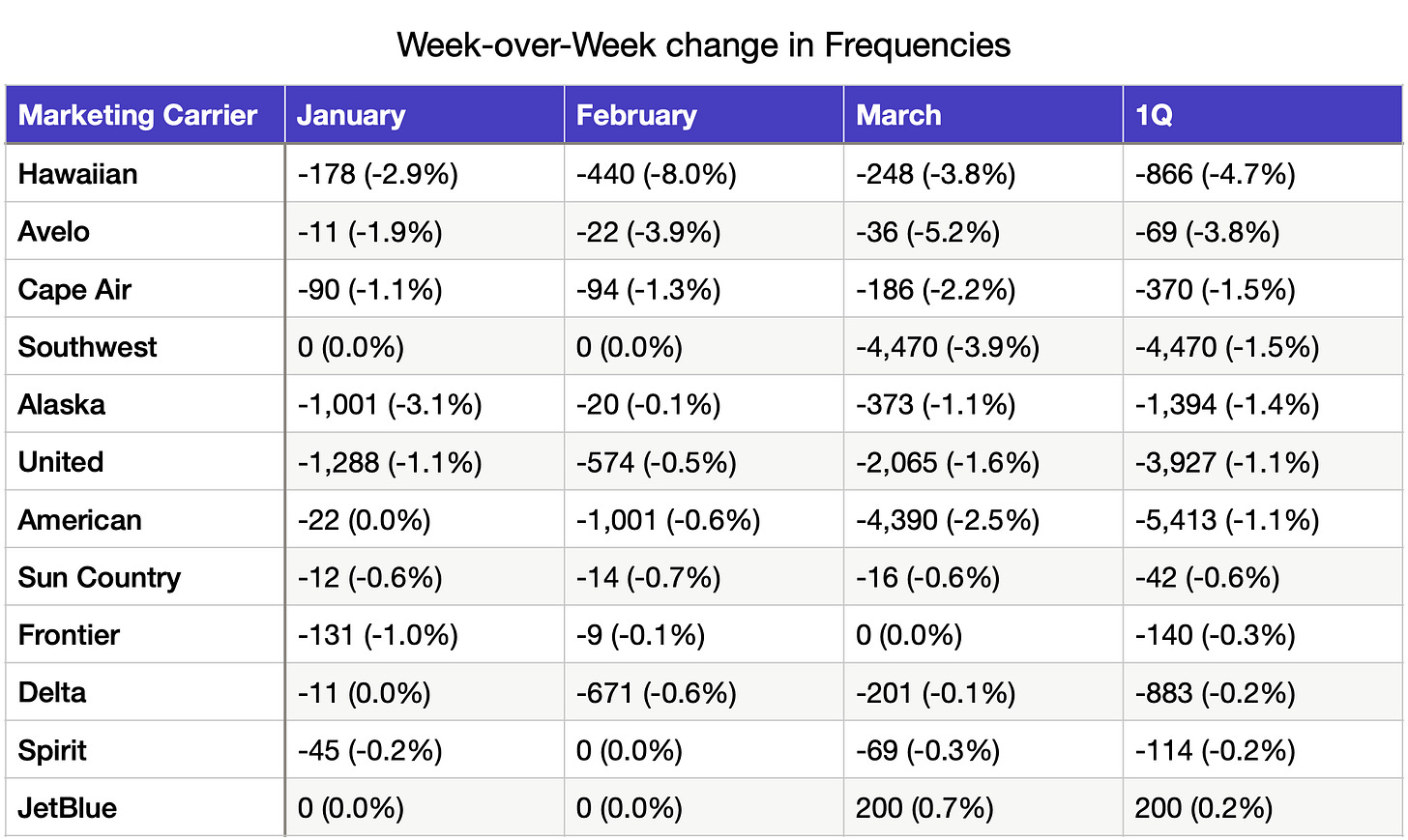

Airlines continued to trim their first quarter selling schedules, removing nearly 17,500 flights with this weekend’s update. We’ll move through this update more quickly than last weekend’s, so if you’re looking for some color on selling schedule cycles as well as how frequency cuts translate to block reductions, we’d encourage you to check out the post below.

What got cut?

Like we did last week, we’ll start off with with a marketing carrier1 view. While American’s reductions were again most voluminous, Hawaiian cut the largest percentage of their schedule.

There were a few interesting tidbits at the market-level:

Hawaiian’s reductions were focused on inter-island for January and February, with frequencies between Honolulu-Hilo (HNLITO), Honolulu-Kona (HNLKOA), Honolulu-Lihue (HNLLIH), Honolulu-Maui (HNLOGG) and Lihue-Maui (LIHOGG) all down 7-10%. Attention shifted to Japan for March, with Haneda (HND) service pushed back to the the last few days of month, as well as schedules pulled down to/from Osaka (KIX, to less than daily) and Narita (NRT, from twice to once daily).

We get to mention Avelo, the nation’s newest startup, for the first time in our blog. They’re growing from Burbank (BUR) and, more recently, New Haven (HVN), however growth occasionally has to be subsidized by pared service elsewhere. In this case, their reductions owe almost entirely to the suspension (effective today) of service between Burbank and Tucson (TUS).

Southwest hit March hard, reducing service by more than 5% to, among other airports, New Orleans (MSY), Tampa (TPA), Los Angeles (LAX), St. Louis (STL) and Fort Lauderdale (FLL). For STL, that included postponing the resumption of Oakland (OAK) and Portland, OR (PDX) service to April.

While not a market-level observation, Alaska’s reduction is even more impressive when considering they only adjusted flights from January 17. When considering just the last 15 days of the month, it’s a 6.3% haircut.

American also pushed back the resumption of Haneda service (to Apr 4). HND slots are (were?) highly coveted, so perhaps some reader deep in the regulatory game knows what’s going on here—we don’t think it’s a coincidence that both HA and AA adjusted schedules there. American also has postponed Los Angeles-Reno (LAX-RNO) service to Apr. 5. Needless to say, those market adjustments by themselves don’t account for the entirety of a percentage-point-plus reduction. Frequencies to/from Medford (MFR) as well as Houston-Hobby (HOU) were cut by at least 20%; Montreal (YUL), Evansville (EVV), Midland, TX (MAF), Boise (BOI), Bakersfield, CA (BFL) ad Burbank were all cut between 10-17%.

Finally, we’d be remiss to not mention JetBlue adding to their March schedule—we hope their optimism proves justified!

How did the cuts impact pilot utilization?

Let’s switch to an operating carrier lens, as pilots fly not for the brand but operator, and recalculate pilot utilization (i.e. the amount of hours each pilot is counted on to fly). Though we’ve withheld some background in today’s post, we will reiterate that pilot utilization comparisons between carriers may not be an apples-to-apples comparison: fleet commonality, base counts, stage length, and bargained incentive pay can all influence outcomes. But we still think it’s at least an apples-to-pears2 comparison and a worthwhile exercise to roughly understand how highly pilot populations3 are leveraged.

While January continues to hold our attention—we’ve sorted the table by January utilization—we are starting to look ahead to February and March. That February is shorter distorts month-to-month comparisons a bit and we’d bet some carriers include a day or two from January or March in the February bid4. To this end, we also calculated a utilization number that controls for days in the month, by which measure aggregate February utilization actually increases 0.96% (and March increases 7.92% versus January).

GoJet (G7) and Southwest (WN) look to remain 1 and 2 for February, suggesting a relatively high level of operational risk associated with each pilot sick call. Despite their March reductions, WN is then set to become the most highly-utilized carrier in March. Alaska’s (AS) January reductions were enough to relax utilization by more than 6% and drop them three spots this month. Allegiant (G4), which reduced their February schedule in last weekend’s update but made no adjustments to first quarter in this weekend’s update, would climb to second mostly highly utilized carrier by March. And we wouldn’t be surprised if another tranche of mainline United cuts loads for March—they’ve gone the deepest of their network peers (American and Delta) for January and February so far—but as as things stand, they’d jump into the top 5 for March (ahead of American).

We’ll again close on a financial note. Like we mentioned last week, these block reductions also pull out ASM’s, which will pressure CASM. There’s also an impact to the cost part of the equation—there’s considerable sunk crew cost associated with close-in reductions, overtime is being exhausted at airports (i.e. gate agents and baggage handlers) and trip interruption expenses are piling. Delta corroborated our speculation when they disclosed that they expect an approximate 3 percentage point impact to 1Q22 CASM-ex5 owing to Omicron-related disruption. American and United earnings are on deck this week, so we’ll see if we get additional insight. For the sake of some back-of-the-napkin math, let’s use 3Q21 expenses (excluding fuel) as a numerator: this weekend’s ASM reductions represent, most notably, a 5.8% increase in CASM for Hawaiian (reports Jan. 25), 2.1% increase for Alaska (Jan. 27) and 1.7% increase for Southwest (Jan. 27).

American, Delta, United and Alaska operate their own flights, considered their Mainline operation (on larger jets, with upwards of 100 seats). These airlines also “purchase capacity” from regional carriers (e.g. SkyWest), wherein the regional carrier operates smaller aircraft (i.e. less than 100 seats) under the Mainline brand.

Plus, this background let’s us resurface our favorite footnote.

In botany, apples and pears are both examples of pomes. A pome is a type of fruit produced by flowering plants in the subtribe Malinae of the family Rosaceae. Source: Wikipedia.

Bet you didn’t think you’d be reading about fruit morphology when you opened this post.

The most recent airline employment data (Nov. 2021, from Schedule P-1(a) Employees) does not differentiate by employee group, so we adjusted 2020 pilot populations (from Schedule P-10) by each carriers’ change in overall employment between the two snapshots. In most cases, this represented inflation, as the weighted average from 2020 reflected something near the bottom.

Crew scheduling assigns flying by calendar month, considering “bids,” though in cases like February may borrow a day from adjacent months to create bids of similar length. At the start and end of bid periods, assigned trips will also span both periods, which may marginally distort month-to-month utilization comparisons.

Cost per available seat mile is a measure of unit cost in the airline industry. CASM is calculated by taking all of an airline’s operating expenses and dividing it by the total number of available seat miles (ASM) produced. Sometimes, fuel or transport-related expenses are withheld from CASM calculations to better isolate and directly compare operating expenses (CASM-ex). Source: MIT Airline Data Project