[Spring Break] Friday Mar. 11 travel

Snow looks to end at ORD early enough as to not impact startup; cold front delivers wintry precip to DFW and gusty north winds to IAH

Last week kicked off Spring Break travel, though early returns were somewhat underwhelming. The TSA screened 2.13 million travelers, which came in underneath both our Holt-Winters forecast (finishing in the 38th percentile) and a more bullish, less sophisticated estimate derived from 2021 patterns. Moreover, Sunday passenger volumes outperformed Friday (by about 2.3%), aligning 2022 with the first weekend of March 2021, rather than 2019 (when Friday outperformed Sunday by about 2.3%). Our Holt-Winters forecast is beginning to pick up on a shifting weekday pattern and gives this Sunday about a 47% chance of beating Friday. As a matter of fact, we were planning to write an outlook for Sunday travel, however weather across the country looks relatively quiet—a good thing, no doubt, for travelers, but leaving us without much to write about.

Welcome to any new readers—we're grateful that you're here! We're building deep learning algorithms to democratize flight delay predictions; until we launch, we're eager to synthesize things manually in our outlooks. These feature several recurring themes that we recognize may be unfamiliar or intimidating, so we’ve written explainers that tackle airport arrival rates, queuing delays in the airspace and different tools to distribute those delays. If there’s a topic or mechanism you’d like to see unpacked, please let us know (same goes for special travel occasions).

So, with our focus returned to Friday, what’s in store for these travelers (however many there are)? Our Holt-Winters forecast projects a modest 3.5% increase week-over-week, with 2.21 million screened. Again, some back-of-napkin math using 2021 patterns is more bullish: Friday, March 12, 2021 screenings grew by 21% week-over-week, which would yield a record-breaking1 2.57 million screenings if applied to this Friday. While we concede such a number is in the realm of possibilities, it’s a fairly distant point in the realm (less than 1 in 20 chance). If we were trying to make the case for extreme bullishness, we’d share that college and university recesses peak this upcoming week, 5 of the 20 largest public school districts2 start break this weekend and SXSW gets underway today. Ultimately, however, we think a 5.2% week-over-week increase is a more reasonable bullish scenario, which would yield 2.24 million travelers screened.

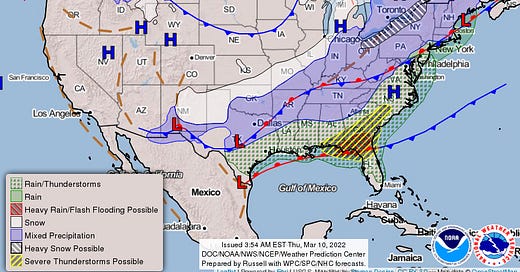

An active weather pattern is forecast, mostly owing to a pair of slow-moving frontal boundaries. The first, which stretches from the Great Lakes to the southern Great Plains, will deliver some light wintry precipitation to the Midwest after generating heavy mountain snow. The second is a quasi-stationary front already draped across the Gulf Coast that will bring moderate rain and scattered thunderstorms to the Southeast. We also want to note that while the Mid-Atlantic and Northeast (e.g. WAS and NYC airports) are indicated to receive precipitation, the valid period for the chart ends at 7 a.m. ET Saturday and conditions are not expected to deteriorate for these geographies until late Friday evening (at the earliest).

Great Lakes

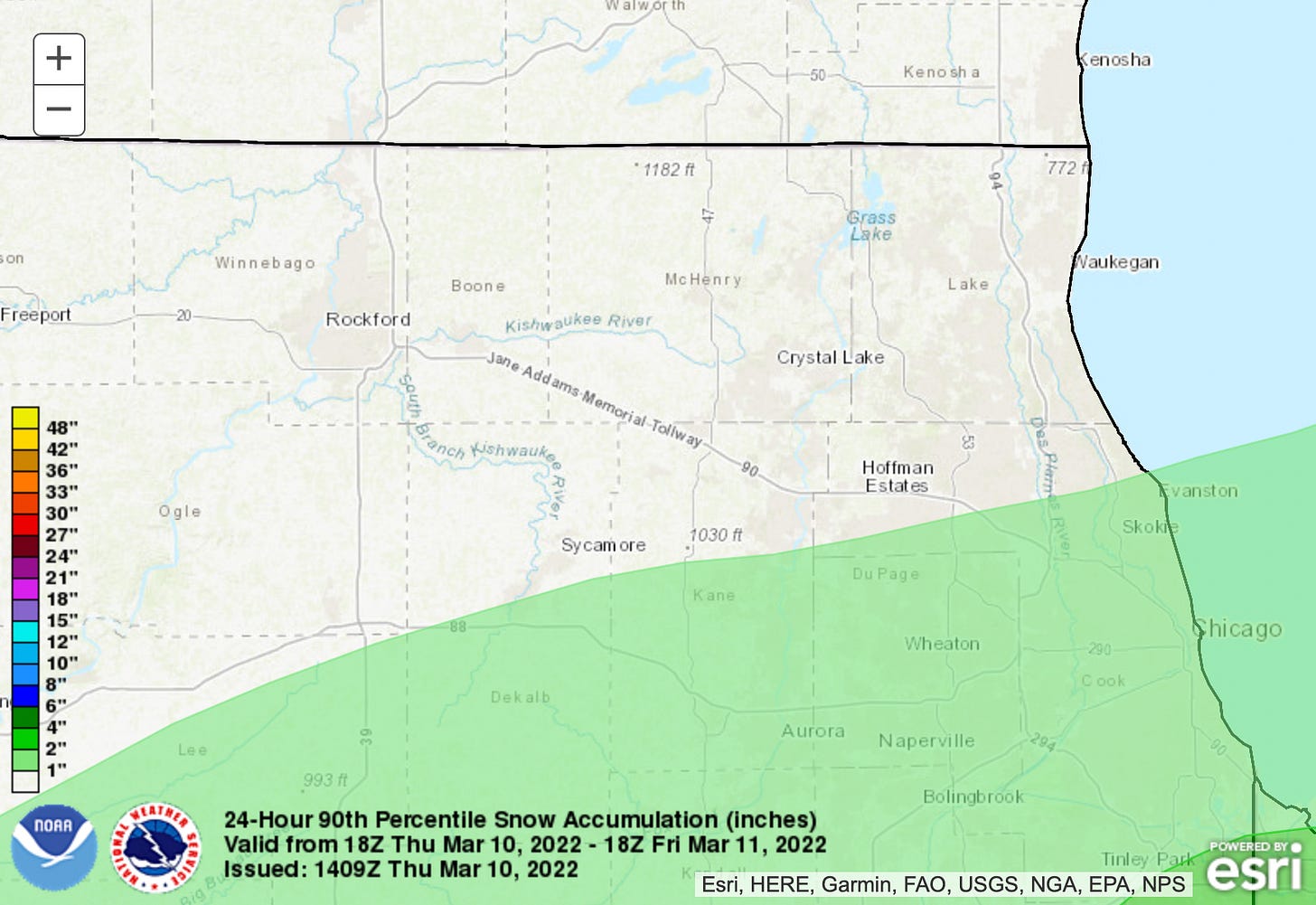

We’ll start at Chicago-O’Hare (ORD), where snow is expected to spread in from the southwest by mid-afternoon today. Recent guidance has trended southeast with the placement of the heaviest snowfall and the forecast discussion from the local weather service office indicates less than 1” is expected. The Weather Prediction Center (another NOAA/NWS outfit) supports this view, with accumulations not reaching 1” until the 90th percentile of their forecast. For it’s part, the short-range ensemble forecast (SREF—also a NOAA product) is a little more bullish, with high-end amounts of 3”; the majority of accumulation falls before 6 a.m. per the SREF and that timing should be applicable to other forecasts. The TAF, as a matter of fact, calls for snow to end pre-dawn, though that’s on the earlier side of end times. That most of the snow is set to accumulate ahead of startup on Friday should help with airfield clean-up. In a broadly positive sign, the local NWS office has held off on hoisting a winter weather advisory.

If snowfall amounts are less than an inch, we think ORD’s arrival rate floor is 100 (1 in 10 chance for lower rates). If snow is slow to taper off and amounts overachieve (i.e. high-end SREF verifies), then there’s a couple worrisome proxies from earlier this season. On Jan. 23, Jan. 24 and Jan. 28, ORD dealt with between 2.2-3.5” of snow. Importantly, intensity remained light, timing was overnight into late morning and they were able to hold onto a west flow in all three instances. In those cases, rates between 32-36 were not uncommon (3 in 10). The first arrival bank of the day occurs in the 7 a.m. hour, when scheduled arrival demand3 is 78, so the question of capacity is plenty consequential. Though it’s arguably unreasonably pessimistic, we modeled a 36 rate in the 7 a.m. hour, stepping up to 86 at 9 a.m. and 100 by 10 a.m.: this scenario produces delays approaching 45 minutes4. Regardless of accumulations, if some flakes linger into mid-morning, departure delays for deicing should be expected.

235 miles to the east, snowfall amounts are similar for DTW, though chances for snow persist through the afternoon. Once again, the amount of snow will have significant bearing on airport capacity. In less snowy solutions, we like 76 for an arrival rate floor (about 1 in 10 chance for equal or lower rates); if snow outperforms, we think 56 is appropriate (1 in 6 for equal rates, less than 1 in 20 for lower rates). Here, though, the different scenarios are of less consequence, as scheduled demand peaks at 41—below even the more pessimistic floor. In the absence of a demand overage, we don’t foresee any air traffic delays at DTW. That said, when snow is falling, deicing delays for departures should be expected.

Texas

A strong cold front sweeps through the Dallas-Fort Worth (DFW) area Thursday night into Friday morning. The arrival of the cold front will be marked by an abrupt wind shift to the north, though this fortunately is set to occur pre-dawn. While just about all the most recent model guidance suggests wintry precipitation is expected, snow/sleet accumulations look to be around 1/10 inch—an amount that pre-treament of surfaces should resolve. (Even points north, along the Red River, are only forecast to receive possibly a half inch.) More so than wind or precipitation, ceilings figure to be the determining variable for DFW. The TAF drops ceilings to around 700’, which is enough to introduce a material chance for a 72 rate (1 in 6). Scheduled arrival demand peaks at 97 in the 9 a.m. hour (with a secondary peak of 86 in the 7 p.m. hour).

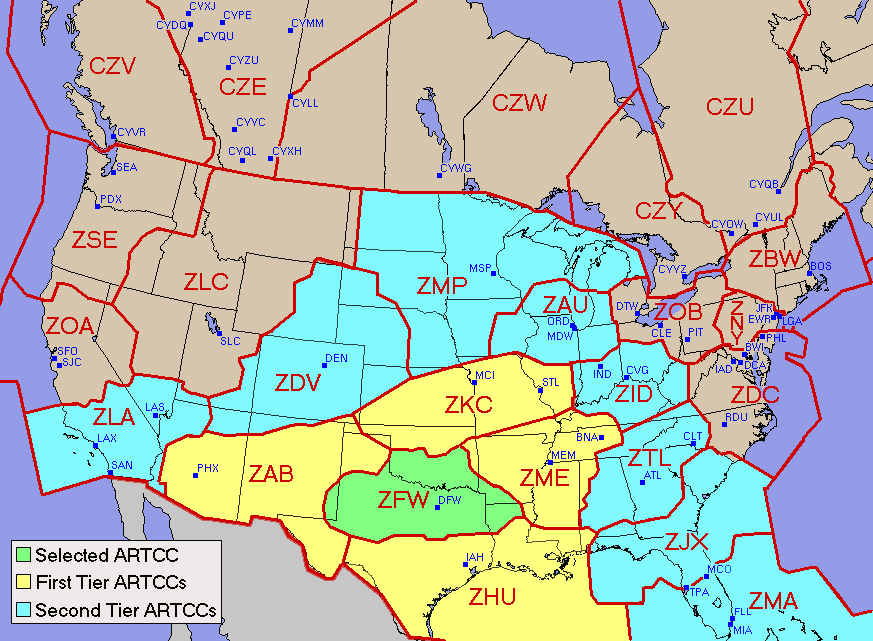

If the FAA takes a wait-and-see approach, which we’d bet they do, they’d be left to reach for a first-tier ground stop to manage the 9 a.m. and 7 p.m. hours. In both of these cases, a first tier ground stop would produce average delays of at least 30 minutes for captured flights (and approaching 60 minutes in the 7 p.m. hour). If the FAA instead elects to publish a ground delay program relatively early in the day, average delays are not modeled to exceed 20 minutes (assuming the GDP is scoped to include all of the contiguous US). One last time, we’ll reiterate that deicing delays should be expected anytime frozen precipitation is falling; unlike ORD and DTW, two geographies well-versed in winter operations, deicing at DFW is not an oft-practiced process.

The same cold front will reach Houston-Intercontinental (IAH) during early Friday afternoon. Widespread rain showers and isolated thunderstorms are expected to accompany the frontal passage for IAH. Though thunderstorms are a wrinkle—possibly restricting airways to/from airport as well as closing the ramp5—we’ll need to most closely watch the winds. Gusty north winds will flood the area in the wake of the cold front, which is doubly unfortunate because Runway 15L/33R is closed. While we’ll compile an appropriately sized training dataset when it comes time to build our IAH model, our sample size is somewhat limited when it comes to manually synthesizing things for this post. With that qualification, we think 64 is a good, albeit not unlikely arrival rate floor (less than 1 in 20 chance for lower rates, at least 1 in 4 for equal rate). Scheduled arrival demand peaks at 76 in the 6 p.m. hour, when a 64 rate and resulting first tier ground stop would produce average delays of 26 minutes for captured flights (with delays lingering into the 7 p.m. hour). There’s also a secondary arrival demand peak of 73 in the 8 a.m. hour, when a 64 rate and resulting first tier ground stop would produce average delays of 17 minutes.

Before we move on from Texas, we want to mention Austin (AUS). Typically we skip non-hub airports, however we think SXSW travel warrants a few sentences. AUS features the lowest visibility (5 miles) and ceilings (400’) of the Texas bunch, though their precipitation type is something of a sweet spot, at least for aviation purposes—a cold rain precludes the problems associated with both wintry precipitation and thunderstorms. Our favored arrival rate is 28 (at least 2 in 5 chance); it also serves as a good floor (about 1 in 6 chance for lower rates). Scheduled arrival demand peaks at 20 (in the 11 p.m. hour), which would generally permit us to move on (i.e. no capacity/demand imbalance exists). However AUS’s unscheduled demand, which does not become apparent until a flight plan is filed (routinely day-of), is already above average and we expect SXSW to amplify this trend. Unfortunately, uncertainty around unscheduled demand6—and therefore how total demand settles out—makes it difficult to speculate about the shape and intensity of air traffic delays, but we want to highlight the potential for them.

Southeast

Moisture will surge northward into the Atlanta (ATL) area during the daytime on Friday. Increasing instability will promote the organization of scattered thunderstorms during the afternoon; some of these storms could be strong to severe during late afternoon and early evening. While the same thunderstorm caveats apply (restricted airways, ramp closures), we think 110 is a reasonable arrival rate floor for ATL (less than 1 in 10 chance for lower rates). Even a worse-case estimate calls for an 80 arrival rate, which should accommodate the schedule demand peak of 75 (8 p.m. hour) with negligible air traffic delay.

Our thoughts are with the people of Ukraine, especially the Kyiv-based designer we partnered with this past fall.

Miles4Migrants, which United and Delta previously partnered with, indicates NGO’shaven’t begun to submit requests for displaced Ukrainians. In the interim, they recommend donating to their partners IRC, HIAS, and UNHCR. Not waiting for Miles4Migrants, United and American have kicked their miles donation programs into gear, with Airlink a beneficiary (among others). Additionally, Lufthansa’s Innovation Hub had a nice round-up of travel-centric donation options in their most recent newsletter.

If your experience reading this post is anything like ours writing it, you’ll check Jon Ostrower’s Open Source Intelligence list on Twitter between every sentence. Given the tone on social media, we’ll be doing less self-promotion for the time being—with that said, we’d be particularly appreciative of anybody who shares this bit of writing.

Cold air damming will be the defining feature of Charlotte’s (CLT) forecast, which makes for a tricky precipitation forecast. The forecaster indicates there is bust potential (i.e. no precipitation). Regardless, ceilings look to fill in around 3,500’ and visibility could conceivably drop to 3 miles. An 80 arrival rate is narrowly more likely than not; it’s also a good floor, with about 1 in 10 chance for lower rates. Scheduled arrival demand peaks at 72 (9 p.m. hour), so we don’t anticipate air traffic delays at CLT.

Recommendations

United has issued a weather waiver for the Ohio Valley, as the system that produces snow for ORD and DTW on Friday will strengthen before impacting the interior Northeast on Saturday. There’s also a couple expiring weather waivers out there for the Rocky Mountains, however applicability to the airports we covered in this post are limited. We will take the opportunity to remind readers that airlines have meaningfully improved general rebooking flexibility by eliminating change fees for most tickets (though a fare difference may still apply). While we spent a spent a lot of virtual ink on ORD, we ultimately think probabilities are low enough as to not recommend rebooking. Trips that transit Texas are a different story, however, and if you’re holding an itinerary that (1) originates in the Southern Plains or Gulf Coast, and (2) includes a mid-morning or early-evening connection in DFW or IAH, and (3) whose layover cannot absorb a delay of at least 30 minutes, we’d at least check out alternative routings.

The high-water mark for COVID checkpoint numbers is 2.45 million (owned by the Sunday after Thanksgiving 2021).

Of 954 college and university Spring Breaks tracked by StudentCity, 397 begin on March 12. 210 begin on March 19 and 183 began on March 5.

Hillsborough, Orange, Palm Beach and Duval Counties in Florida begin break on March 12, as does Dallas ISD.

Cargo airlines as well as private jets are not included in scheduled demand and only become apparent when they file a flight plan (generally day-of). This unforeseen demand introduces the risk that delay probabilities/intensities are under-forecast. Unscheduled demand added 9.1% to scheduled demand for Core 30 airports year-to-date (through Mar. 1). For the airports we’ll consider today, only AUS (29%) is above average by this measure.

While our modeling is aimed at tackling arrival delays, there's a strong correlation to departure delays (albeit with some lag and/or possible alleviation). Consider a scheduled "turn" at an airport: the inbound flight is scheduled to arrive at 2:19 p.m. and departs at 3:30 p.m. (71 minutes of turnaround time). Let's say the inbound is delayed by 40 minutes and instead arrives at 2:59 p.m. We'll further assume that the airline doesn't need the full 71 scheduled minutes to turn the aircraft and can accomplish the turn in 45 minutes if they hustle - the departure will push back from the gate at 3:44 p.m. (delayed by 14 minutes). In this example, a 40 minute arrival delay in the 2 p.m. hour is partially passed through to a departure in the 3 p.m. hour. Had the turnaround been scheduled at 45 minutes instead (i.e. no turnaround buffer), the lag between arrival and departure delay would still exist, however the delay would be fully passed through.

Additionally, our efforts are aimed at diagnosing air traffic delays (i.e. those that result from an imbalance between capacity and demand). Though not the focus of our efforts (yet), delays owing to aircraft servicing, airline staffing, network effects, etc. are always lurking.

When lightning occurs in the vicinity of the airport, baggage handlers and fuelers (among other workgroups) are pulled off the ramp, thus halting aircraft turnarounds.

We’re working on a sub-model to forecast unscheduled demand, however an ad-hoc forecast of AUS’s unscheduled demand tomorrow is beyond the scope of this post.