Summer 2022 Air Travel Primer

We estimate recent schedule cuts have saved travelers more than $80 million in lost time; even so, we'd put chances at greater than 9 in 10 for increased air traffic delays versus last year.

In our last disruption outlook, we posited that we’d pick the series back up with a post covering travel this weekend. But after moving in near-lockstep with 2019 patterns since March (albeit at lower absolute levels), it appears TSA throughput has broken its tidy year-over-three correlation. In 2019, traveler volumes turned upwards again at the first Monday of May; this year, the 7-day moving average of TSA screenings continued to drift downwards for another week.

We’ll take advantage of this one-week lag to look ahead to summer air travel, when the TSA expects passenger volumes will rival 2019 levels for the first time since the pandemic began.

An uneven recovery (more like a relapse)

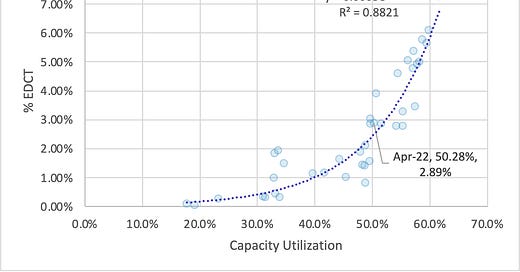

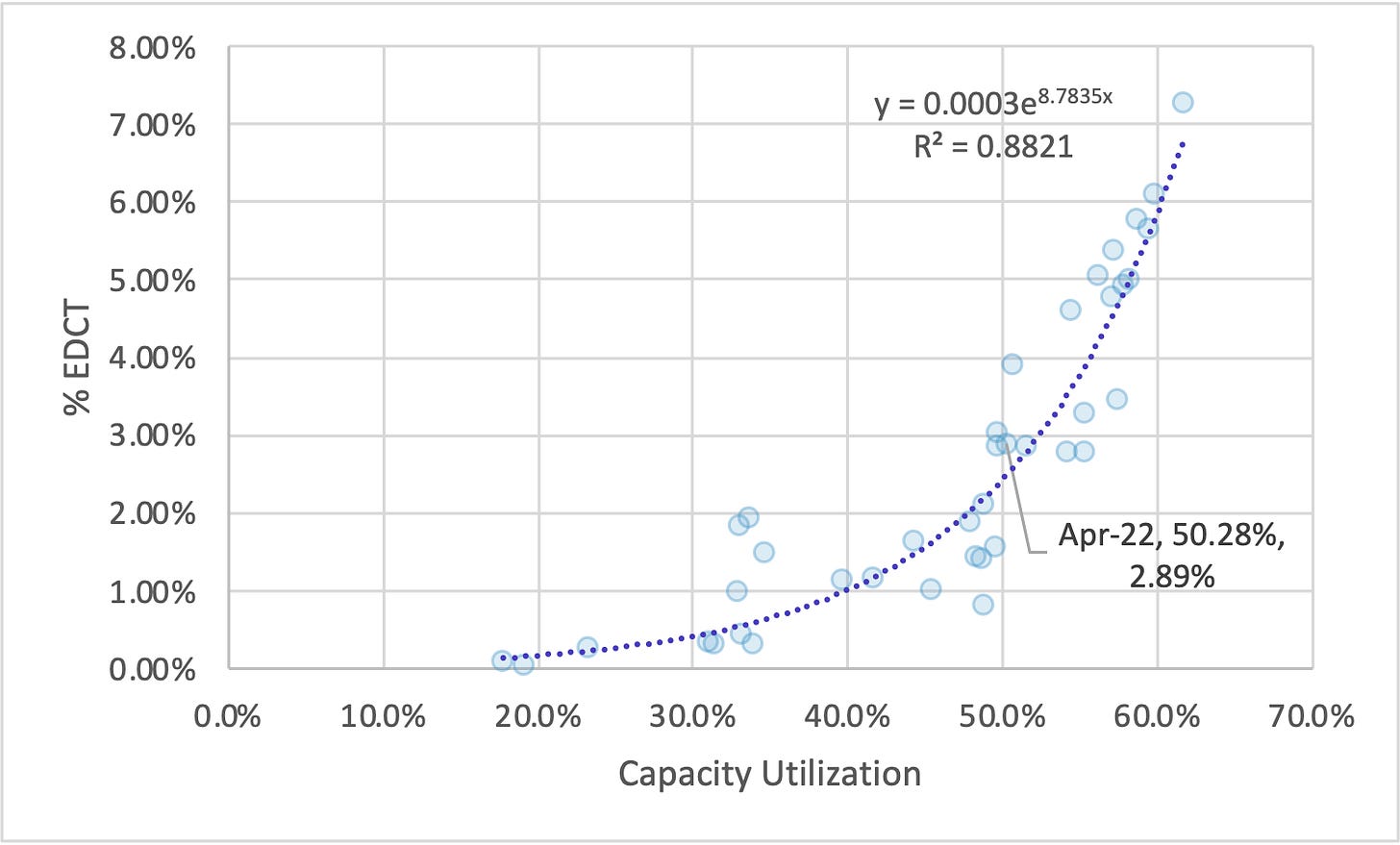

Before we prognosticate about what this summer might look like, let’s provide some context vis-à-vis the frequency of air traffic delays during the last three years. For an indicator, we’ll use the percentage of arrivals to the FAA’s “core” 30 airports1 that are assigned an EDCT (estimated departure clearance time; often called a wheels up time). Briefly, EDCTs marshal the queueing that results when demand for an airport’s runway(s) exceed their capacity. We attempt to quantify the relationship between demand, capacity and EDCTs below; if you're curious about the conceptual underpinnings, we’d encourage you to check out our explainers.

During the 12-months-ending February 2022, 1.85% of core 30 arrivals were assigned an EDCT. That’s up considerably from the 12-months-ending February 2021 (1.01%), though still well off of “normal” levels (4.78% for 12-months-ending Feb. 2020). In August 2021, air traffic delays reached their highest frequency since COVID’s onset (and the attendant evaporation of airspace system demand). While demand had recovered to 83% of 2019 levels, last summer’s surge in EDCT incidence owed largely to the capacity side—in some cases, airports took advantage of one more year of depressed demand to accelerate runway rehabilitations. As a result, aggregate capacity2 in July and August was lower than any of the same months from 2010-2019 (June would have ranked third lowest).

There’s also the matter of Florida, where air traffic delays really started to rear their head in August of last year: EDCT incidence at FLL, MIA, MCO and TPA more than doubled year-over-two3. The FAA has indicated they’re augmenting staffing and developing an always-trusty playbook to hopefully ameliorate Florida air traffic delays by summer. We’ll see.

Let’s DTR (That’s “define the relationship” for our non-Millennial readers)

So there’s reason to believe capacity should increase year-over-year—will those gains outpace increased demand? Scheduled demand is fairly straightforward. Based on what’s selling in OAG’s May 9 snapshot (more on that in a bit), scheduled arrival demand at core 30 airports for June through August is set to increase by 10.2% year-over-year. Accounting for unscheduled demand (i.e. cargo airlines and private aircraft that do not file schedules with the likes of Cirium or OAG4) is a little trickier: we built a Holt-Winters model that points to a 14.2% increase year-over-year. Taken together, we expect total (i.e. unscheduled and scheduled) arrival demand at core 30 airports to increase by 10.9% year-over-year (and to within 92.2% of 2019 levels).

If there’s a little uncertainty around unscheduled demand (the model’s standard error is about 5,600 flights—or 0.59% of total forecast July demand), then there’s a lot of uncertainty around capacity. As referenced in footnote 2, we’re using the arrival rates that are central to our disruption outlooks; unlike our disruption outlooks, where we’re concerned with hourly rates, we’re summing arrival rates across hours and airports5 for this primer. If capacity returns to 2010-2019 averages, we’d expect July-August capacity at core 30 airports to increase by 3.1% year-over-year.

You wouldn’t be wrong to conclude that demand growing at a quicker pace than capacity conveys bad things for delays. But to what extent? To answer that, we need to quantify the relationship between demand, capacity and delays. For the purposes of this post6, let’s turn the problem into a [simpler] two-dimensional exercise. To accomplish that, we’ll take demand as a percentage of capacity7: we can call it capacity utilization. Having winnowed our problem down to two variables (albeit one of which reflects the interplay between two components), we can spin up a scatter plot with capacity utilization on the x-axis and EDCT incidence on the y-axis.

We only went back to 2019, but even a sample size of 40 months produces a serviceable r-squared value of .88 (which is to say that 88% of variance in EDCT incidence is explained by our capacity utilization calculation). Crucially, there’s an exponential relationship between EDCT incidence and capacity utilization; nicely, Excel derives the equation that defines the relationship. That it’s exponential in nature means increases in capacity utilization compound to destabilize operational performance with greater rapidity. For example, a one percentage point increase in capacity utilization from 54% to 55% could be expected to increase EDCT incidence by 32 basis points. The same one percentage point increase in capacity utilization from 60% to 61% could be expected to increase EDCT incidence by 54 basis points.

Alright. Back to our question of what’s in store for this summer. Assuming capacity is in-line with 2010-2019 averages, capacity utilization figures to be in the range of 53.9% (June) to 54.8% (August). That level of utilization places us on a section of the curve that corresponds to an EDCT incidence in the range of 3.4% to 3.7%. Across June, July and August, we’d expect core 30 EDCT incidence to increase 36 basis points year-over-year to 3.59%, assuming average capacity. But that’s a big assumption—the relative standard deviation of our capacity measure is 2.7%. So let’s use that standard deviation to produce a range of possible EDCT outcomes8.

A couple interesting probabilities to highlight:

Better than 2 in 5 chance (43.9%) to exceed last August’s high-water mark of 3.91% in at least one of June, July or August;

Nearly 1 in 4 chance (22.8%) that June, July and August each exceed last year’s comp.

Some tempered assurances about reliability from airline CEO’s

You likely noted that we charted two sets of predictions for each month. The predictions informed by OAG’s May 9 snapshot (the latest selling schedules) reflect our current expectations for this summer’s environment. We also produced predictions using the [out-of-date] April 18 snapshot to understand the expected benefit from airlines’ recent summer schedule reductions. While JetBlue has garnered the bulk of headlines in this respect, they’ve hardly been by themselves in this pursuit. In the three weeks between snapshots, JetBlue pared June-August frequencies by 7.4%, Southwest by 5.6%, United by 1.1% and Delta by 1.0%. For the 10 largest marketing carriers (by frequency), the aggregate summer reduction was 2.5%9 during the last three weeks.

Although these reductions have no doubt resulted in some frustrating itinerary changes, they should buoy the operational integrity of the national airspace system (and allow airline leadership to equivocate about summer reliability). Reduced demand serves to depress our capacity utilization measure, which shifts us down along the exponential curve. Had these schedule cuts not been implemented, we could have expected capacity utilization to be in the range of 55.3% to 55.5%, given average capacity. (To save you from scrolling up, the May 9 snapshot yields a corresponding range of 53.9%-54.8%.) In the median estimates, schedule reductions knocked 32 basis points off of summer EDCT incidence, including 44 basis points from June.

Interestingly, we can also perform an exponential regression of EDCT delay minutes10 against capacity utilization (and r-squared gets even better!). Repeating the April 18 vs. May 9 snapshot exercise with delay intensity suggests schedule cuts saved nearly 4,500 hours of EDCT delays. And that likely understates the benefit—one delay tends to ripple through the remainder of the day. An FAA-sponsored study derived a national multiplier of 1.57, which indicates that reductions prevented an additional 2,500 hours (7,037 hours total) of delays from propagating across the national aviation system. What’s the value of saving those delays? There’s also an FAA-sponsored study for that (and 2019 update). While we didn’t reproduce their regression modeling, some back-of-napkin math implies $145 million in cost avoidance, including $80 million in passengers’ time, $19 million in indirect economic destruction and $11 million in welfare loss11. For their part, the airlines stand to save $37 million in direct operating expenses.

Employee utilization—but not of the pilot variety

Okay. We’ve (hopefully) established that recent cuts to summer schedules have likely prevented a meaningful amount of disruption, but delays are still set to increase year-over-year. How do we think airlines will handle increased delays? While Network Planning is more rigidly bound by pilot availability, we’d bet they’re willing to accept more risk when it comes to airport staffing levels. Unfortunately, thinly-staffed airports aren’t adept at absorbing delay. This is the case in terms of individual flights (e.g. an agent gets stuck working a flight delayed by aircraft maintenance, preventing them from transitioning to their next task), but it’s especially true when an entire schedule slides later in the day [beyond shift go-home times].

We estimated the size of airport-based12 airline employee populations for March, which is latest available. Initially we considered these population estimates relative to flight activity and were met with relief—it seemed that airlines had generally increased the number of agents per departure year-over-three. But then we recalled the regional pilot shortage that’s roiling the industry and wondered what its impact on gauge (i.e. average seats per departure) was. Sure enough, March gauge was up 6.5% vs. 2019 for the six marketing carriers we’re considering. Because larger aircraft require more agents to handle, we think the more appropriate question to ask is how many seats is each agent expected to handle. Importantly, these ratios are not comparable across carriers due to varying reliance on ground handling vendors (e.g. Swissport), who are not considered airline employees. While an airline’s vendor/employee mix could admittedly change, we think it’s a worthwhile measure across time for the same carrier.

Good news first: In aggregate, we estimate agents were expected to handle 3.4% fewer March seats vs. 2019, with utilization having relaxed at United (UA), Southwest (WN), Alaska (AS) and Delta (DL). Now the bad news: it looks like agent utilization at American (AA), the nation’s largest carrier, increased by 3.7%. American joins Frontier (F9, 12% increase) and JetBlue (B6, 1.2%), who also appear to have more highly-leveraged airport staffing year-over-three. While airlines’ ongoing hiring efforts may yet resolve any agent shortage, how could this dynamic manifest itself at airports? We wouldn’t be surprised to hear anecdotes this summer about flights arriving late owing to “normal” air traffic delays that then wait 30 minutes or more for marshalers or a jet bridge driver.

Oh, yeah—what about 5G?

Oh, yeah—we’d kinda forgotten about that too. Alarmingly, we seem to be careening towards another FAA-telecom standoff, this one just-in-time to disrupt July 4th travel. DOT Secretary Buttigieg contends they’re making progress, but concedes the issue won’t be fully resolved by July 5, when AT&T and Verizon are slated to activate airport-adjacent antennas. In the interim, it sounds like the FAA is pushing for airlines to replace or retrofit altimeters. We’ll keep an eye on developments in this space (wireless carriers twice deferred antenna activation at the eleventh hour in January); for the moment, our explainer on the topic remains largely applicable13.

ATL, BOS, BWI, CLT, DCA, DEN, DFW, DTW, EWR, FLL, HNL, IAD, IAH, JFK, LAS, LAX, LGA, MCO, MDW, MEM, MIA, MSP, ORD, PHL, PHX, SAN, SEA, SFO, SLC, TPA

Measured by the sum of efficiency airport arrival rates for 2019 reportable hours.

More recently, March 2022 EDCT incidence at FLL, MIA, MCO and TPA increased by nearly 1,300% year-over-three. However, a relatively narrow focus on the four Florida core 30 airports understates the problem: Palm Beach (PBI) is the most delayed airport year-to-date among ASPM 77 airports. En-route constraints (especially at Jacksonville Center) overlay and exacerbate terminal constraints.

Unscheduled activity also nets out scheduled cancellations.

We’re also considering only reportable hours, which are intended to represent the busiest hours of the day. We’ve observed that recorded arrival rates are not reflective of weather conditions during non-reportable hours, i.e. controllers may not be diligent in adjusting rates for IMC during non-reportable hours. Reportable hours vary by airport. Reportable hours also vary by fiscal year, however the UI required we select just one year—we picked 2019.

For the purposes of our forthcoming app, our data scientist is exploring much more sophisticated machine learning techniques (like an attention-based neural network).

Total (i.e. scheduled and unscheduled) monthly demand for all hours/monthly efficiency AAR for reportable hours; for core 30 airports.

Wherein the numerator (total forecast demand) is left unchanged and 99 different denominators (percentiles 1-99 of 2010-2019 capacity) are used to produce a range of capacity utilization values.

While we worked to account for capacity uncertainty, there’s some uncertainty around unscheduled demand that’s not accounted for. There’s also model error: for what its worth, June, July and August 2021 all had positive forecast errors (including August’s +1.3 percentage point error) as did the two most recent months.

Across all airports, not just core 30. June reduction was 3.3%, July 2.2% and August 1.9%. Some reductions—especially August—may not have been in response to operational concerns but part of normal timeline for updating selling schedules.

The back-of-napkin math divided the FAA-estimated 2019 cost by total delay minutes of domestic flights operated by large air carriers. For example, $18.1 billion in passenger cost divided by 95.9 million delay minutes equals $188.76 passenger cost per minute of delay.

Indirect costs reflect the cost to non-airline sectors that result from lost productivity (either as a result of higher fares or lost employee time). Welfare loss represent cost of transportation mode switching (e.g. road congestion). Sum of components does not equal total cost due to rounding.

This includes baggage handlers and customer service representatives as well as their direct supervisors, i.e. general aircraft traffic handling, passenger handling and cargo handling categories from Schedule P-10. Latest available data for Schedule P-10 (by category) is 2021, which reflects a weighted annual average—we adjust this by monthly total FTE from schedule P-1(a).

We’re considering AA, AS, B6, DL, F9, UA, WN, which are the 6 mainline carriers with at least 1,000 employees in the aforementioned categories.

The FAA has since approved altimeter models installed on, most notably, the CRJ and A220 families—with those additions, 90% of the U.S. commercial fleet is approved to perform low-visibility landings at airports where wireless companies deployed 5G C-band. The ERJ-145 and “some” ERJ-170/175’s remain unapproved.

Being between 3 hubs is always fun during diversion seas— er, I mean summer.

I share your skepticism about the FAA program to relieve FL traffic issues. Will be very happy to be proven wrong if it comes to that.