The one where we estimate that 6 hours of CAT II conditions in SEA cost nearly $150,000

Plus a quick look at changes to first quarter pilot utilization

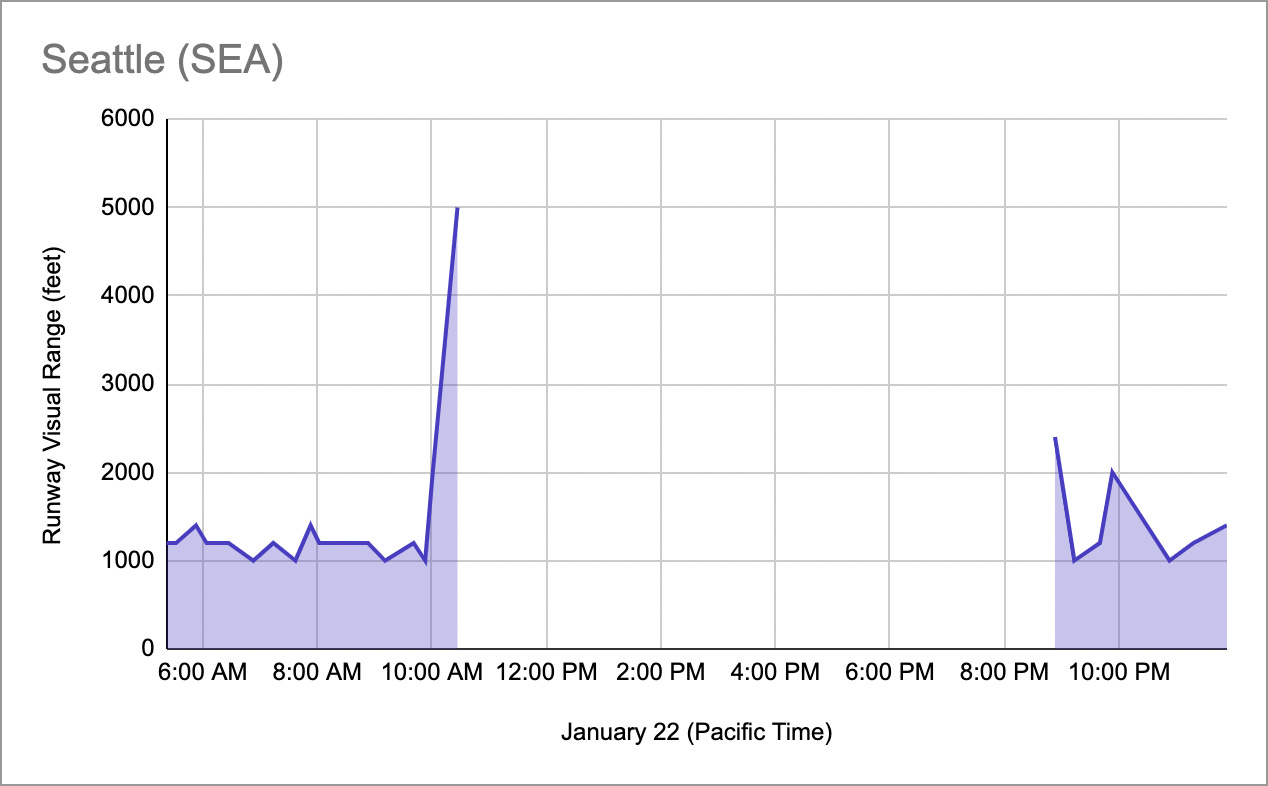

Fog in Seattle (SEA) pushed RVR’s to around 1,200 feet1 through mid-morning on Saturday. Conditions would briefly improve to VFR during the afternoon, only for RVR’s to again lower to 1,000 feet by the 9 p.m. hour. To the best of our knowledge (and we’ve been keeping a pretty close eye on it), Saturday was the second time a hub dropped below CAT I minimums since 5G was deployed on Wednesday. San Francisco (SFO) would inaugurate 5G delays on Thursday, when RVRs dipped as low as 800 feet. Extensive airborne holding and a handful of diversions may have made SFO’s disruption feel more acute, but—as we’ll unpack—SEA still racked up a not insignificant bill. While we’ll tackle the cost of SFO’s event in the future2, we believe SEA’s is more representative of the level of disruption that can be expected for as long as some altimeters are unapproved.

Airlines were surprisingly risk-tolerant when it came to launching SFO-bound flights on Thursday morning, which lead to the airborne holding when RVR’s weren’t quicker to improve than forecast. It’s tough to say if it was in response to Thursday’s diversions or unrelated, but it seemed like airlines were more inclined to wait for improvement before launching SEA-bound flights on Saturday. Though there’s cost (and environmental) implications we’ll consider shortly, whether the delay is absorbed in the air or on the ground, the aircraft—as well as its crew and passengers—arrive late all the same in a binary sense. There’s two aircraft models operating into SEA that would have been of chief concern owing to an unapproved altimeter: the Bombardier Q400 (17% of arrivals) and the Airbus A220 (4%). Our estimate is these two models arrived on-time3 into SEA at a rate of just 55% on Saturday, 18 percentage points worse than models with approved altimeters; Q400 and A220’s were also 38 times more likely to be cancelled.

Airline Operating Costs

So it appears those aircraft with unapproved altimeter were uniquely unreliable, presumably4 on account of CAT II conditions. To determine the cost of SEA’s disruption, let’s start with $74.21 per minute5 of delay: this reflects the expenses directly incurred by the airline to operate the aircraft. The first adjustment we’ll want to make is to back-out the fuel costs. If these delays were absorbed in the air or during taxi, when engines were running (and omitting CO2), it would be an applicable expense category; as is, we’ll assume all delay was absorbed before pushing back from the gate. This assumption may understate cost somewhat (while we observed very little airborne delay, we’d bet some delay came in the form of a long taxi-out). Excluding fuel knocks the cost down to $48.98 per minute and leaves crew costs as the largest cost category. We should note that crew costs (both pilots and flight attendants) are the only part of our analysis that may overstate cost—we’re not familiar with various collective bargaining agreements, but in some cases, pay may not start until the flight pushes back from the departure gate.

The second adjustment we need to make is to scale cost for the size of the aircraft. Crew costs, especially, vary with the size of the aircraft: smaller aircraft require fewer flight attendants (pilots, too, occasionally) and are generally staffed by more junior (read: less expensive) crew. We’ll use seats as a proxy for size, by which measure the Q400 (76 seats) and A220 (109-130) come in underneath average gauge (127.7 seats) for the most part. We’ll also want to identify how much delay is attributable to 5G deployment—even in the absence of CAT II conditions, we’d expect some about of baseline delay. So it’s really just the excess delay we want to tally in our cost calculations. We debated how best to do this and settled on calculating an expected delay for a flight with an approved altimeter6 then applying to all flights with an unapproved altimeter.

Finally, we need to account for cancellations. Surprisingly, this is more straightforward: we borrowed a cost of $1,050 per uncontrollable regional cancellation from a MasFlight analysis. All cancellations are considered excess, as the cancellation rate for approved models applied to unapproved models rounds down to 0. Alright—enough with methodology, let’s get to results.

The last remark we’ll make about airline costs concerns a propensity for delays to ripple through a network. Our relatively narrow focus on SEA arrivals very likely understates the true cost to airlines (and passengers, for that matter), as it did not capture (1) balance cancellations7, (2) delays to SEA departures due to late arriving aircraft or (3) instances where delays to unapproved aircraft knocked onto8 approved aircraft.

Value of lost passenger time

We suspect some of our readers may not be particularly sympathetic for the airlines, though the second half of our cost estimate should resonate across the board. Here too, we’ll start with a publicly available number and make adjustments for the current environment: the FAA recommends using $0.785 per passenger per minute for air travel9 as a value of lost time. The central question we have to answer in this section is how many passengers were on each disrupted flight. Once again, we’ll adopt a conservative10 tact and assume load factors are equal to those reported for the first quarter of 2021. For the Q400 (operated by Alaska Airlines’ subsidiary Horizon Air), this means we’ll use a load factor of 52.1%, which equals 39.6 passengers per flight; for the Delta-operated A220’s, an assumed load factor of 45% equals between 49.1 and 58.5 passengers.

We also needed to answer how many minutes a cancelled passenger was delayed, which is mostly a product of rebook-ability. For this, we turned to an FAA-sponsored study, which indicates the average delay for cancelled passengers is 449 minutes11. To this end, some delayed passengers likely misconnected in SEA, in which case our estimates understate the lost time.

When considering both direct airline operating expenses and the value of lost passenger time, the cost of 6 hours of CAT II conditions in SEA sums to $147,707.

No boilerplate needed about explainers for this one, though we still want to welcome new readers—we’re grateful you’re here!

Instead, we’ll use this space to solicit data science help. While aviation domain knowledge (or numerical weather prediction, for that matter) would be a bonus, it’s certainly not a requirement: we’re confident we could coach any interested data scientists through the problem at a conceptual-level. Compensation would be in the way of an equity grant, though—as this post hopefully hints at—it’s an economically valuable problem. If modeling the airspace system piques your curiosity (and you’d have 10 or so hours per week to spend on the problem), drop us an email at join@aerology.ai or reply to this email!

Selling schedule changes: an abbreviated edition

With January and February seemingly settling out (and much of the industry’s focus on 5G deployment), we’ll pare this week’s coverage of selling schedule changes. Accordingly, we’ll keep color commentary to a minimum—if you’re curious about selling schedule cycles, our pilot utilization methodology or implications of utilization, we’d encourage you to check out the Jan. 8 edition.

US airlines12 removed net 64 frequencies for the remainder of January in Saturday’s update, or just 0.01%. Alaska Airlines trimmed 479 flights from their February schedule, or 1.51%; otherwise, no carrier cut their February schedule by more than 0.20%. On the other hand, Current Schedules teams continued to hack at March, removing more than 12,300 flights. JetBlue reversed direction from last week—when they added 200 flights to March—cutting approximately 1,700 flights (6.54%). On a percentage basis, Spirit lead the way, with a 7.65% reduction; Alaska, Frontier, Southwest and United all trimmed their March schedules between 1.5-3.5%. So what did this mean for pilot utilization?

While we’ll sort by January utilization for one more week, we’re largely looking ahead to the remainder of first quarter at this point. Alaska’s (AS) February cuts relaxed leverage enough to drop them two spots, to 10th. Meanwhile, by standing pat again, Allegiant (G4) is set to become the most highly utilized carrier in March. And finally, as we speculated last week, United was more aggressive with this week’s March reductions than their network peers and are no longer in the top 5 for March.

If RVR and CAT I are unfamiliar terms, we’d recommend checking out our explainer on low visibility as it relates to 5G deployment.

tl;dr when RVR—or runway visual range, the distance a pilot should be able to see down the runway—is less than 1,800' feet, aircraft with unapproved altimeters are prohibited from landing.

Data on delay types, to include airborne, is made available on the 20th of the following month.

While the DOT employs a 15 minute buffer to schedule to determine on-time, we’re considering any positive difference from schedule a delay.

Additionally, we had actual landing time available to us from FlightAware and scheduled gate arrival time from OAG, though bulk actual gate arrival time was unavailable. We applied the average taxi-in for that hour (from ASPM) to derived estimated actual gate arrival time.

The alternative is these aircraft models are inherently unreliably because they’re more difficult to turn or staff, i.e. Saturday was not an anomaly attributable to 5G and instead they’re always arriving on-time at a rate that’s 18 percentage points worse than other models. The latest delay reason data (Oct 2021) suggests this is not the case: only 3% of Q400 and A220 arrivals to SEA were assigned an air carrier delay, more than 4 percentage points better than other aircraft models.

Source: Airlines for America, based on DOT Form 41 data

Median non-negative delay, delayed flights with approved altimeter * percent of delayed flights, approved altimeters = 16.8 minutes * 27.5% = 4.6 minute expected delay

If BIL-SEA cancels, then SEA-BIL must cancel in all likelihood to prevent an un-routed aircraft being stuck in BIL.

E.g. unplanned peaking of airport resources, delays to accommodate late-arriving connecting passengers.

Source: Treatment of Time

For the most recent available quarter, Alaska (Q3) and Delta (Q4) have reported a 24 and 36 percentage point gain in year-over-year load factors, respectively.

Derived from Table 3-6 on page 32.

For marketing carriers 9K, AA, AS, B6, DL, F9, G4, HA, MX, NK, SY, UA, WN, XP.

American, Delta, United and Alaska operate their own flights, considered their Mainline operation (on larger jets, with upwards of 100 seats). These airlines also “purchase capacity” from regional carriers (e.g. SkyWest), wherein the regional carrier operates smaller aircraft (i.e. less than 100 seats) under the Mainline brand.