First look: Monday, Dec. 27 travel

Plus analysis of cancellation trends at Delta, JetBlue and United

Welcome to any new readers — we're grateful that you're here! We're building deep learning algorithms to democratize flight delay predictions; until we launch, we're eager to synthesize things manually in our outlooks. These feature several recurring themes that we recognize may be unfamiliar or intimidating, so we’ve written explainers that tackle airport arrival rates, queuing delays in the airspace and different tools to distribute those delays. If there’s a topic or mechanism you’d like to see unpacked, please let us know (same goes for special travel occasions).

Merry Christmas to our readers who celebrate!

Nearly 2.2 million travelers were screened by the TSA on Thursday (for that matter, checkpoint numbers were quick to rebound above 2 million on Wednesday), however Omicron-related flight cancellations quickly gained control of the holiday travel narrative. We had actually written about this possibility on Tuesday:

We also want to highlight one non-weather theme that’s likely to play a part in outcomes at all airports: Omicron’s influence on already-lean airline staffing levels. Case counts among airline employees are no doubt following the country’s upward trend and, needless to say, an employee who tests positive is expected to stay home. Unfortunately, because airline employees often work in small teams, one positive case can have a multiplicative effect, wherein their close contacts are required to quarantine. Rising case counts also seem likely to produce more closures of FAA facilities (to allow for cleaning), though impacts should mostly be confined to overnight periods.

We saw the first signs of this early Thursday morning, when Chicago O’Hare (ORD) operated at a reduced capacity on account of contact tracing among air traffic controllers. While that story didn’t escape aviation circles (despite our best efforts), when United Airlines started to cancel flights—citing Covid cases limiting crew availability—the broader public took notice. United ended up with 201 cancels (per FlightAware) on Friday, with Delta1 (173 cancels) and JetBlue (80 cancels) following suit.

Unsurprisingly, the schedule reductions were not confined to Friday. American, Delta, JetBlue and United have combined to cancel more than 750 flights scheduled to operate today (as of 6:45 p.m. ET). More than 225 U.S. flight cancellations are already on the books for Sunday, though we suspect that number will grow substantially by the time the dust settles on tomorrow’s operation. We’ve noticed some geographical and aircraft type tendencies in these cancellations that we suspect will persist through Monday (at least), so before we get to weather impacts (of which there’s no shortage), we wanted to share our analysis.

Flight cancellations trends

By itself, this information may not warrant rebooking; when coupled with probabilities on weather-related disruption, we hope it’s the nudge some travelers may need to proactively re-book. In situations like this weekend, when disruption is pervasive, rebooking options will generally shrink the closer to departure one gets.

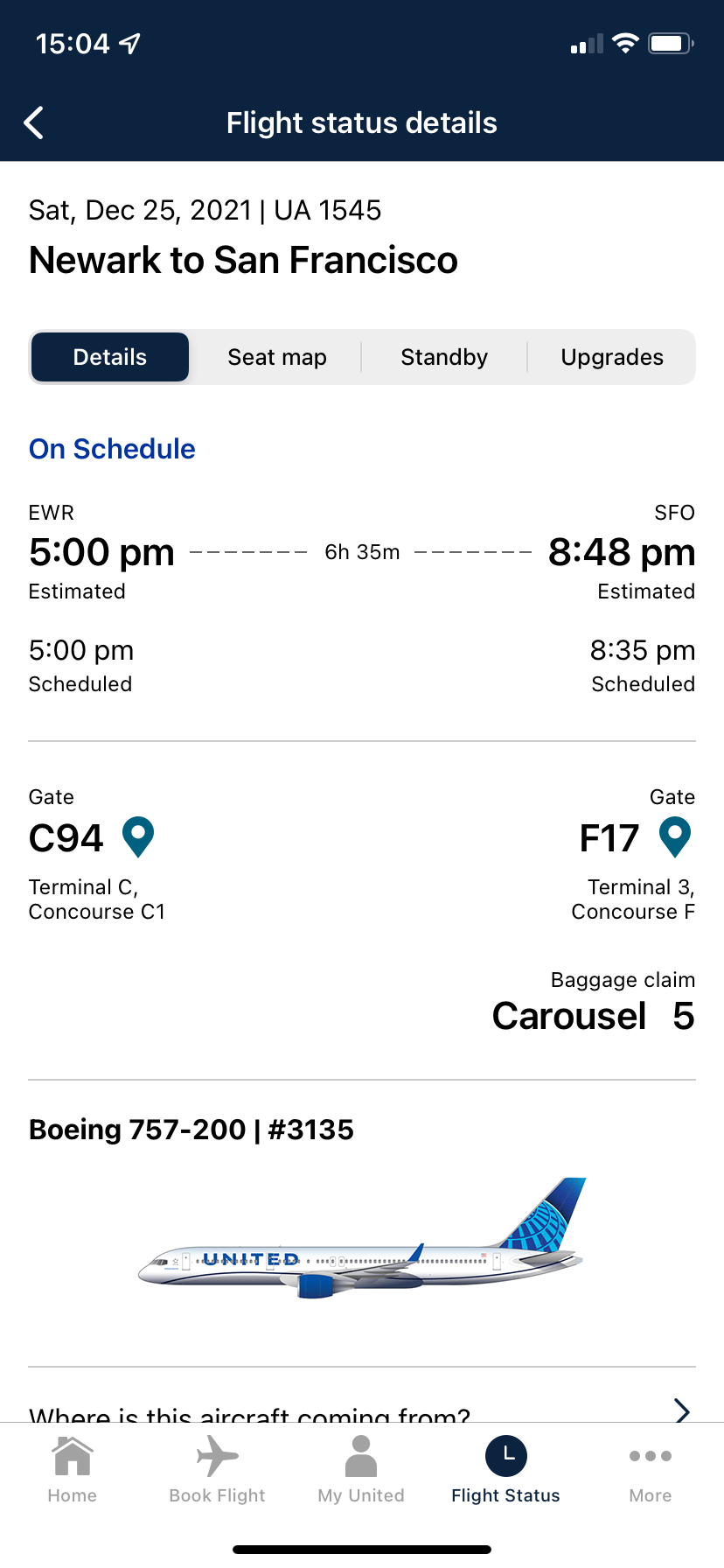

The first theme we want to highlight is arguably the most surprising: regional carriers have fared substantially better than Mainline carriers the last couple days. These regional airlines operate flights using smaller aircraft (i.e. less than 100 seats) under the Mainline brand. We say surprising because a structural pilot shortage has been roiling the regional carriers and they presumably headed into this Omicron peak in a more tenuous staffing posture. For further reading on the topic, we’d highly recommend The Air Current’s excellent analysis on the topic. While Delta and United have cancelled 12-15% of their Mainline operations today, regional carriers have kept cancellations rates to 5% or less. Airlines take great care to make Mainline and regional experiences indistinguishable, though the relationship would be disclosed on a flight status page. For American and Delta, this will be noted towards the upper-left hand corner, underneath the flight number; for United, this will be noted at the bottom of the page.

For Delta and United’s Mainline operations (as well as JetBlue), we were working through some FlightAware data incompleteness, though believe we still have a representative sample when considering today’s cancellations (data current as of 12:30 p.m. ET). United’s cancellations have revealed a few trends that readers may want to consider when evaluating an itinerary:

While cancels have been voluminous within the Boeing 737 fleet (72% of all of United’s cancels have been scheduled on a 737), we’d actually worry more about an trip that includes a Boeing 757 or Boeing 767 (which share a pilot group thanks to cockpit commonality). Though 757’s and 767’s are less prevalent, more than 1 in 5 have been cancelled (“only” 1 in 8 flights scheduled on a 737 have been cancelled). Like the operator, aircraft type can also be found at the bottom of United’s flight status.

Geographically, Washington-Dulles (IAD) has fared marginally better than other hubs, though more than 1 in 20 IAD departures have still been cancelled. Oppositely, about 1 in 8 departures from Denver (DEN), Houston-Intercontinental (IAH) and Los Angeles (LAX) have been cancelled.

While United kicked things off Thursday afternoon, Delta has actually assumed the unenviable spot at the top of cancellation laggardboards:

Their 737 fleet has been a safer bet (less than 1 in 20 cancelled), though their 757 and 767’s have been similarly picked on (1 in 5 cancelled). In Delta’s app, you’ll need to select “View More” and aircraft type will be at the top of the drawer.

Geographically, Delta has seemingly protected Boston (BOS), where fewer than 1 in 20 flights have been cancelled; there’s also an interesting dichotomy in New York City, wherein about 1 in 20 flights from JFK have been cancelled while nearly 1 in 5 LaGuardia flights have been cancelled.

JetBlue is somewhat of a unique case, operating the Embraer E190 for themselves (this family of aircraft, to include the E170, is typically operated by a regional carrier under the aforementioned capacity purchase agreement). We mention this because JetBlue has cancelled more than 1 in 8 E190’s flights today, while their larger aircraft types (Airbus A220 and A320) have been kept to less than 1 cancellation in 10 flights. We weren’t able to glean a worthwhile story from American’s cancellations (mostly on account of small sample size—to American’s credit).

Weather and Air Traffic Control

Unfortunately, unsettled weather across much of the country on Monday figures to hamper airlines’ efforts to navigate crew shortages. Pacific moisture will continue to barrage the West; moreover, cold air has recently moved in and may allow for snow to fall in coastal and valley areas that typically see rain. Meanwhile, a storm system emerges across the Upper Midwest on Sunday afternoon and brings precipitation to the Mid Atlantic on Monday.

Capacity at nearly half of the FAA’s core 30 airports2 will potentially be constrained (and we’ve already spent a considerable amount of virtual ink on cancellation trends), so we’re going to tackle air traffic impacts tabularly today. This exercise should hopefully help us to narrow our focus for tomorrow’s update, when we’ll dive a bit deeper into individual airport dynamics. For today, we’ll provide what we think is a reasonable floor for an airport’s capacity (i.e. 1 in 10 chance for lower arrival rates) as well as another lower-end-but-more-likely estimate (i.e. 1 in 4 chance for equal or lower arrival rate). We’ll also highlight the two hours with the highest scheduled3 arrival demand—recall from the explainers, when demand exceeds capacity, delays result.

Alright. So [mercifully] not quite as alarming as the map initially suggested. Still, we’ll revisit forecasts for Newark (EWR), Philadelphia (PHL) and Seattle (SEA) in tomorrow’s update (our homework is to derive some predictions for average delay length). We’ll also keep a close eye on cancellations for any signs of improvement headed into Monday. For the moment, we’d be most concerned about any trips on Delta that include a Boeing 757/767 and a morning layover in SEA; we’d also be anxious about travels on United that include a Boeing 757/767 and an evening layover in EWR. That said, uncertainty is high enough that we’d start checking out alternate routings, though probably stop short of confirming the new itinerary.

We were excited to learn that Substack featured our blog on their homepage. It may sound cheesy, but it’s true — we wouldn’t have been selected if it weren’t for our readers, so thank you from the bottom of our hearts. Saturday is the last day we’ll be spotlighted, so if you’ve been thinking about sharing our blog with somebody, now could be an especially good time!

United and Delta Mainline. American, Delta and United operate their own flights, considered their Mainline operation (on larger jets, with upwards of 100 seats). These airlines also “purchase capacity” from regional carriers (e.g. SkyWest), wherein the regional carrier operates smaller aircraft (i.e. less than 100 seats) under the Mainline brand.

ATL, BOS, BWI, CLT, DCA, DEN, DFW, DTW, EWR, FLL, HNL, IAD, IAH, JFK, LAS, LAX, LGA, MCO, MDW, MEM, MIA, MSP, ORD, PHL, PHX, SAN, SEA, SFO, SLC, TPA

Cargo airlines as well as private jets are not included in scheduled demand and only become apparent when they file a flight plan (generally day-of). This unforeseen demand introduces the risk that delay probabilities are under-forecast. Unscheduled demand added 9.6% to scheduled demand for Core 30 airports between 11/15/2021-12/14/2021.

Excellent review. One note on possible ATC delays: Published AARs on the OIS page represent best case for the given runway configuration and weather. On day of operation, Tower calls configuration and TRACON calls the rate, with a number of factors that can modify the published max rate for the configuration. Keep up the good work! Don/Chief ATC Coordinator United Airlines (retired).

Thanks for making these free. I’m really enjoying learning about something I’ve never been exposed to before.