Update: Sunday Jan 2. travel

Omicron introduces additional staffing constraints; watching weather in Mid Atlantic, Southeast and Pacific Northwest

Welcome to any new readers — we're grateful that you're here! We're building deep learning algorithms to democratize flight delay predictions; until we launch, we're eager to synthesize things manually in our outlooks. These feature several recurring themes that we recognize may be unfamiliar or intimidating, so we’ve written explainers that tackle airport arrival rates, queuing delays in the airspace and different tools to distribute those delays. If there’s a topic or mechanism you’d like to see unpacked, please let us know (same goes for special travel occasions).

While we write, we’re keeping an eye on how things unfold at Chicago O’Hare (ORD) this evening. Snow should end predawn tomorrow, which would afford the airport and airlines about 3 hours to get things cleaned up before the schedule really spools up. There’s a sizable schedule reduction already in place for ORD tomorrow (23% of departures canceled per FlightAware, as of 9 p.m. ET), which should help to facilitate recovery. Unless snowfall rates overachieve and the wheels come off1 yet this evening—leaving crews and planes scattered about—we’d expect a generally stable operation by tomorrow morning. The latest forecast discussion cast some doubt on how efficient lake enhancement may be, so snow seems more likely to under-perform, if anything.

The greater risk to travelers itineraries tomorrow looks to be in the way of Omicron-related staffing constraints. Disruption owing to pilot availabilities has garnered the most attention thus far, though the story is growing to include air traffic controllers and, most recently, airport employees. Dallas-Fort Worth (DFW) will operate at a reduced arrival rate this evening, having closed one of its two air traffic control towers. It appears Detroit (DTW) will have less than their full complement of snow plow drivers and it’s unclear how much of the 2-4” inches of new overnight snow will be cleared by the 7 a.m. arrival bank. Unfortunately, these staffing-related disruptions are far less predictable, with the FAA’s every-other-hour Operations Plans advisories often providing the best notice (scroll to the bottom of the FAA’s NAS dashboard and select View Full Operations Plan).

Mid Atlantic

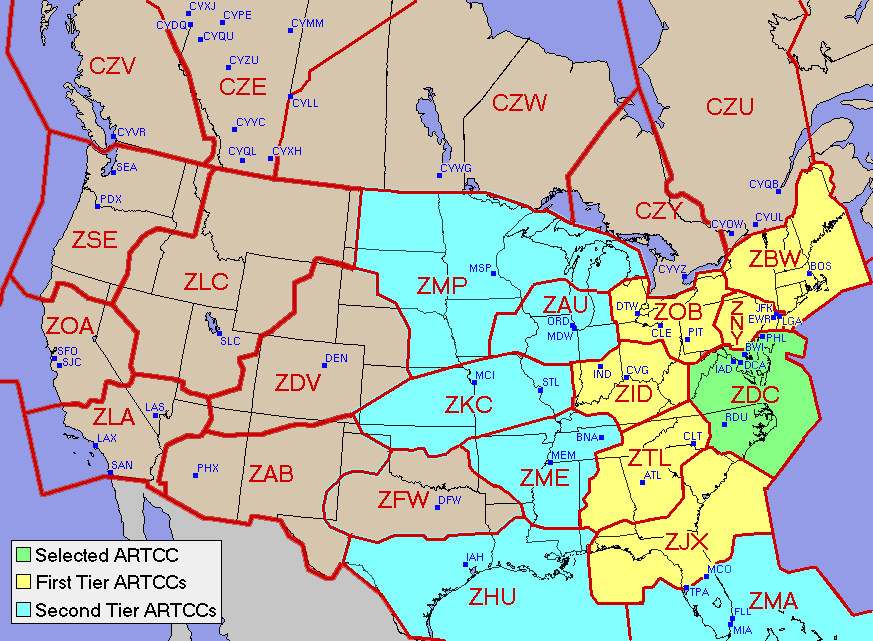

In terms of more predictable disruption, we’ll start our updated survey in Philadelphia (PHL). Rain should come to an end Sunday morning, however the cold front will remain hung up across the region and overcast skies prevail. As the front gets pulled through during the afternoon/evening, a gusty (and chilly) northwest wind will develop. This results in a setup wherein weather conditions are forecast to be quite different for the airport’s two highest demand periods. Ceilings look to be around 800’ and visibility near 4 miles during the 8 a.m. hour, when 48 flights are scheduled2 to arrive. We think there’s a nearly 2 in 5 chance for an arrival rate between 28-32 during this time. If a 32 rate is realized, we bet the FAA reaches for a first-tier ground stop to manage the demand overage, which would distribute delay disproportionately to those flights originating within 600 miles or so. We’ve modeled average delays of 23 minutes3 for these “captured” flights, with delays lingering into the 9 a.m hour.

Ceilings and visibilities will have lifted by 6 p.m., when 45 flights are scheduled to arrive, though gusty northwest winds will have kicked up. This combination exerts less pressure on arrival rates: chances are less than 1 in 5 that airport capacity falls short of scheduled demand. Though probabilities for disruption are lower in the 6 p.m. hour, consequence would actually be a bit higher4 (25 minute average delays for first tier arrivals).

Up the road, the weather set-up is unsurprisingly similar at Newark (EWR) and New York-LaGuardia (LGA), with the stalled frontal boundary providing abundant cloud coverage and winds becoming more northwesterly late. There are a couple important differences in the details to note, including early morning fog (with visibilities to 1 mile) and ceilings being slower to lift (staying at or below 2,500’ through afternoon). Demand is more uniform (and backloaded) at both EWR and LGA, so if airport capacity is sufficiently pressured, delays will more persistent than PHL. Let’s tackle LGA first.

We think LGA may open up at a 28 arrival rate (1 in 5 chance), however visibilities should begin to improve after sunrise and we’d bump up our floor to 30 (1 in 6 chance) starting at 8 a.m. We’ve modeled an all-scope5 ground delay program that produces an average delay of 24 minutes across the day; average delays peak around 50 minutes from 7 p.m. to 9 p.m.

We’ll set EWR’s arrival rate floor at 32 (1 in 10 chance for equal or lower rates), though we think a 36 arrival rate is more appropriate for this exercise—there’s at least a 1 in 4 chance for rates to dip this low and, as we’ll see in a moment, it still produces plenty of delay. Scheduled arrival demand sharply increases starting at 1 p.m. and from 2 p.m. to 5 p.m. is between 37-45 aircraft per hour. There’s a brief—but insufficient—reprieve in the 6 p.m. hour before demand peaks at 48 in the 7 p.m. hour. An all-scope ground delay program would produce average delays of 18 minutes for arrivals after 3 p.m.; average delays peak at nearly 30 minutes in the 8 and 9 p.m. hours.

Charlotte (CLT)

A band of showers and embedded thunderstorms will sweep down across the Carolinas early morning ahead of the cold front (a chance for non-convective showers lingers into mid-morning). The front will be stalled just southeast of the area by evening and while clouds will also be abundant here, they’ll be more of the mid-level variety. Notably, the TAF holds off an abrupt wind shift that we were concerned about during yesterday’s first look. If thunderstorms are slower to move across the area than forecast, some airborne holding is possible during the 8 a.m. arrival bank.

Otherwise, our airport capacity concerns owe to the more ordinary twins, ceilings and visibilities. We’d put CLT’s arrival rate floor at 70 (1 in 8 chance for equal or lower rates), which should be enough to prevent the depth of capacity/demand imbalances we’ll potentially encounter in the Mid Atlantic. Still, we should mention the 8 a.m. hour (73 scheduled arrivals) and 9 p.m. hour (79 scheduled arrivals). Miles-in-trail (MIT) should sufficiently manage the morning overage (we’ve modeled maximum delays less than 30 minutes). The evening imbalance is a little more marginal for the use of MIT and we could envision some same-center metering (SCM), which would stick the closest-in flights (e.g. originating from AVL, CAE, GSO) with delays conceivably reaching 45 minutes.

Seattle (SEA)

There’s a chance for some light rain during the early morning hours, but the main batch of rain associated with the next system is not expected until afternoon. A 40 arrival rate looks to be a serviceable, if not unlikely, floor (at least 1 in 3 chance). We’ll be paying closest attention to the 10 a.m. hour, when scheduled arrival demand peaks at 46 in the 10 a.m. hour. We’ve modeled a first tier ground stop in this case of a 40 rate, with delays for captured flights averaging 30 minutes. A 40 arrival rate would also result in some minor demand overages (i.e. 1-2 scheduled aircraft) in the 2, 6 and 8 p.m. hours, though MIT should do the trick and we’ve modeled maximum delays to stay below 20 minutes.

Recommendations

There’s a few itineraries for which we would encourage itinerary holders to explore alternate routings. In a rough order of descending risk:

If you’re connecting in PHL around 9 a.m. and originating from within 600 miles or so;

If you’re connecting in EWR after 3 p.m. and your layover is scheduled at less than 45 minutes;

If you’re connecting in SEA around 11 a.m. and originating from within 600 miles or so;

Though most traffic at LGA is O&D6, any layover under 60 minutes will be a risky proposition (especially during the evening);

If you’re connecting in CLT around 10 p.m. and originating from within 300 miles or so.

The good news is airlines have meaningfully improved rebooking flexibility by eliminating changes fees for most tickets (though a fare difference may still apply). We’ve linked to the same-day change policies for American (who operates hubs in PHL and CLT), Delta (who operates a SEA hub) and United (who operates a EWR hub).

Indicators include flights inbound to ORD diverting, flights outbound from ORD returning to the gate.

Cargo airlines as well as private jets are not included in scheduled demand and only become apparent when they file a flight plan (generally day-of). This unforeseen demand introduces the risk that delays are under-forecast. Unscheduled demand added 9.6% to scheduled demand for Core 30 airports between 11/15/2021-12/14/2021. For the airports we’ll consider today, only PHL (17.7%) are above average in this regard.

While our modeling is aimed at tackling arrival delays, there's a strong correlation to departure delays (albeit with some lag and/or possible alleviation). Consider a scheduled "turn" at an airport: the inbound flight is scheduled to arrive at 2:19 p.m. and departs at 3:30 p.m. (71 minutes of turnaround time). Let's say the inbound is delayed by 40 minutes and instead arrives at 2:59 p.m. We'll further assume that the airline doesn't need the full 71 scheduled minutes to turn the aircraft and can accomplish the turn in 45 minutes if they hustle - the departure will push back from the gate at 3:44 p.m. (delayed by 14 minutes). In this example, a 40 minute arrival delay in the 2 p.m. hour is partially passed through to a departure in the 3 p.m. hour. Had the turnaround been scheduled at 45 minutes instead (i.e. no turnaround buffer), the lag between arrival and departure delay would still exist, however the delay would be fully passed through.

And of course, delays resulting from aircraft servicing, airline staffing, network effects, etc. should be expected (and are not included in our modeling).

This is because the 9 a.m. hour, with only 8 scheduled arrivals, provides ample room to catch up; the 7 p.m. hour, with 21 schedule arrivals, provides comparatively less.

For LGA, all-scope extends only as far as 1,500 miles (DEN excepted) on account of the Port Authority’s perimeter rule.

LGA does not primarily serve as a connecting hub. Rather most passengers either start (origin) or end (destination) their trip at LGA.