Why'd Mesa delay their 10-K?

Doesn't seem like a healthy indicator. Plus a look a year-end holiday capacity.

It’s been several months since we checked in on the health of regional carriers—though owing less to any sort of stability within the industry and more so to our beta launch. 🚀

But since we last sized-up the regional pilot pool, it was revealed1 that Republic had petitioned for an exemption to the 1500-hour rule, several carriers raised pilot pay rates and the FAA denied Republic’s proposal. So when we woke up to a Monday morning email from Mesa IR about delayed earnings, we figured this would be a good week to circle back on the topic. We’ll approach this post with a slightly different tack: Rather than estimate the depth of the pilot shortage, we’ll take a stab at some financial projections. We think it’ll make for a more interesting analysis insofar as we’re putting ourselves out on a branch. Admittedly, our previous pilot population estimates are tough to verify; our accounting forecast will be proven right or wrong in short order.

What news do we think might be lurking in Mesa’s yet-released earnings? Let’s outline some drivers and assumptions, starting with revenue:

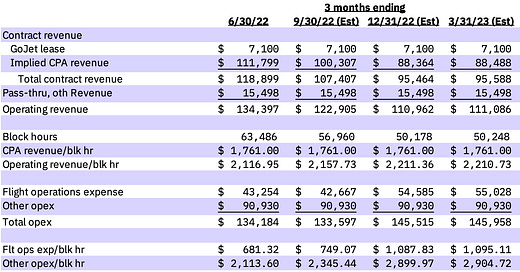

We’ve backed out $7.1 million from the Contract Revenue line—this represents lease revenue associated with rent GoJet pays to Mesa for 20 CR7s. It leaves $111.8 million as implied CPA2 revenue for the quarter ended Jun ‘22; we’ve taken this amount and divided by flown block hours for that quarter ($1,761 CPA revenue per block hour).

We’ll hold that $1.7k CPA revenue/block hour constant as forward-looking block varies. We used block amounts from the Dec 5 OAG snapshot and believe selling schedules through March3 are reasonably representative of airlines’ intentions. To account for DHL flying not in OAG and not-completed block, we’ve given OAG block hours a 5.8% haircut (equal to quarter ended Jun ‘22 flown block as percentage of OAG block).

We’ve carried pass-through and other revenue forward from the quarter ended Jun ‘22.

While unit revenues for CPA flying are flat by design, tumbling block hour capabilities convey decreasing total revenues. Setting aside the DHL/completion factor for the moment, block hours for Jan 2023 are set to be down 39% year-over-year. GoJet lease and pass-through revenue buoy the top-line somewhat, but we still estimate total revenues for the quarter ending Mar 31, 2023 will be down 10% year-over-year.

As for costs:

Mesa was among the above-mentioned carriers who raised pilot pay rates and their bump was advertised as “industry-leading.” We’ll turn to always-handy Form 41 data, where Piedmont’s $920 pilot and co-pilot expense per air hour was highest among the regionals for the quarter ended Jun ‘22. Mesa was at the bottom of this range, coming in at $407; to jump all its peers calls for a 126% increase in pilot wages.

Pilot wages fit into the Flight Operations expense line, which also encompasses flight attendant and dispatch personnel (as well as pubs and lodging). Using the same Form 41 data, we estimate pilot wages made up 47% of the line for the quarter ended Jun ‘22; we believe a 126% increase in pilot wages will flow through to a 60% increase in Flight Operations line per block hour by the quarter ended4 Dec 31, 2022 (equal to $1.1k; like CPA revenue/block hour, we’ll hold this constant while varying forward-looking block).

We assume the remaining operating expense lines5 are fixed and are carried forward at their amount for the quarter ended Jun ‘22.

So what do we have? Mesa presumably raised pilot pay with the expectation that it would attract a greater share of pilots and therefore increase its block hour capabilities. But such a strategy works with a lag and in the interim there appears to be a precarious squeeze occurring. Until block hours can find a bottom, revenues continue to sink; at the same time, variable unit costs have increased owing to the bump in pilot pay and fixed costs are spread across fewer block hours. Given the above assumptions, Mesa swings to a loss of $10.7 million for the delayed-quarter ending Sep 30, 2022. And the projected loss widens to $35 million for the first two quarters of calendar year 2023.

With an estimated $80 million in operating losses on deck, we’re left to wonder if Mesa can make it to the other end of the block-hour-capability-tunnel. We’re a blog6 and this is a back-of-napkin exercise, so we’re going to take the liberty of ignoring non-operating costs (e.g. loss on investments, interest expense, taxes) and cash flows (i.e. cash flows from investing and financing activities). But this back-of-napkin math is something of a red flag: Mesa had $58 million in cash and cash equivalents on hand at the end of Jun ‘22.

There are some green shoots in terms of block hour capabilities. While there’s still time for cuts, Feb ‘23 and Mar ‘23 are both set to notch month-over-month gains in daily block hours; this comes on the heels of month-over-month declines in 9 of the 10 preceding months. But bouncing off a block bottom will only beget narrowing losses initially—by our math, Mesa would need to nearly double block hour output to breakeven. Given all the same assumptions as above, flown block would need to equal 103k hours to achieve an operating profit. To contextualize this, Mesa flew 116k block hours in the quarter ended Dec ‘19, though they did so with 17 more aircraft in-schedule. Absent taking on additional aircraft rent (or finding an interested party for their CRJ-200’s), they’d need to push aircraft utilization to 9.2 hours per day. Not an inconceivable level, but we wouldn’t bet they have the runway to reach it.

Pre-pandemic, it was tough to prognosticate about travel patterns for holidays that are not anchored to a particular weekday; changes to traveler behavior resulting from COVID make it a doubly challenging exercise. So we’re not going to try! Instead we’ll look to airline capacity and commentary.

Tomorrow actually features the most domestic capacity of the period, though Thursday the 22nd edges it out in terms of total capacity (by 2,600 seats—less than one tenth of one percent). American shared that they expect the 22nd to be their busiest day; for their part, United expects January 2 to be their busiest day. We’ve penciled in bookend outlooks covering travel on Dec 22 and Jan 2. As for tomorrow… while not tranquil, low pressure tracking north from the Carolinas will at least deliver rain7 to the coastal Northeast (in contrast to the interior Northeast, where the system will produce up to 2 feet of snow).

Regional airlines provide flying to mainline carriers under capacity purchase agreements (CPA), wherein the mainline partners pay a rate that varies with the number of completed flights, flight time and the number of aircraft under contract. This also includes flight services agreement (FSA) with DHL, in the case of Mesa.

Schedules from OAG, Cirium, etc. only loosely reflect the airlines’ plans beyond a 90-120 day horizon; moreover, COVID caused that horizon to contract, though airlines have been working to push it back. While selling schedules are maintained on an ongoing basis, there’s typically one “major” update when each month’s schedule is cutover to a more realistic facsimile. We think March is the furthest-out month to have undergone its major load: it looks like this occurred alongside the Nov 21 snapshot for American and Dec 5 snapshot for United. For more commentary on major loads, check out this January post covering selling schedules changes or this March post about aircraft utilization.

Note, on account of the IATA calendar, the last 6 days of March will likely be updated with the April major load.

Because the pay rate increase was effective September 15, we pro-rated the quarter ended Sep ‘22 accordingly. Additionally, there’s a 1% increase to pilot wages in 2023.

These include maintenance, aircraft rent, general & administrative, depreciation & amortization and other expenses. If you were to make an argument that one of these buckets was variable, it’s probably be maintenance; but for the quarter ended Jun ‘22, block hours were down 26% year-over-year while maintenance expensed ticked down just 4%.

And notably, the structure of CPAs protects the regional carrier from rising fuel prices—but they don’t enjoy the benefit of falling oil either.

Seems like this one might require the “this is not investment advice” disclaimer, just to be on the safe side.

You know that old joke about how after a nuclear war, the only thing left will be cockroaches? The aviation equivalent here is YV. No one's really sure how (or why) they're still alive, but here we are.

Almost 25 years ago, I clocked out of there for the last time. I would miss my friends, but consoled myself thinking that the carrier wasn't long for this world anyway; we were short too many pilots, UA had just terminated their contract with us, and reliability was something you could only say while using air quotes.

Silly me.