Welcome to our new readers—we're grateful that you're here! We're building deep learning algorithms to democratize flight delay predictions; until we launch, we're eager to synthesize things manually in our outlooks. These feature several recurring themes that we recognize may be unfamiliar or intimidating, so we’ve written explainers that tackle airport arrival rates, queuing delays in the airspace and different tools to distribute those delays. If there’s a topic or mechanism you’d like to see unpacked, please let us know (same goes for special travel occasions).

Having most recently written about about ourselves and Delta’s Atlanta operation, specifically, it’s been a minute since we surveyed air travel with a more holistic lens. So let’s return to our bread and butter: check-in with TSA checkpoint volumes then prognosticate about a couple airports tomorrow. (Plus a couple sentences on cancellation trends.)

Anticipation built for months. It felt like we were being teased—right up to the line, but couldn’t figure out how to cross it. When it finally happened, there was a confusing sense of relief—and it briefly seemed like it’d be a regular occurrence?

We’re of course talking about the TSA setting and resetting recovery records for daily screened travelers1. To wit, the TSA screened 2.451 million travelers on the Sunday after Thanksgiving 2021; that high-water mark was unimpeached for six months, until 2.455 million were screened on June 24. That record stood for just two days, though June 26 would also boast a relatively short reign. The TSA screened 2.491 million on July 1 (Friday of the holiday weekend), handily surpassing June 26 by nearly 30,000 travelers. And since then? Another relative dry spell.

Last Sunday was nearest to July 1’s checkpoint numbers, though—at 2.446 million screened—it wasn’t particularly close. While it may be difficult to beat the bump that a long weekend provides, our moving average at least continues to trend up; more than could be said at this time last summer. For its part, our Holt-Winters model gives tomorrow a 29% chance to set a new recovery record (though it’s still under the influence of some [depressed] holiday Sunday throughput).

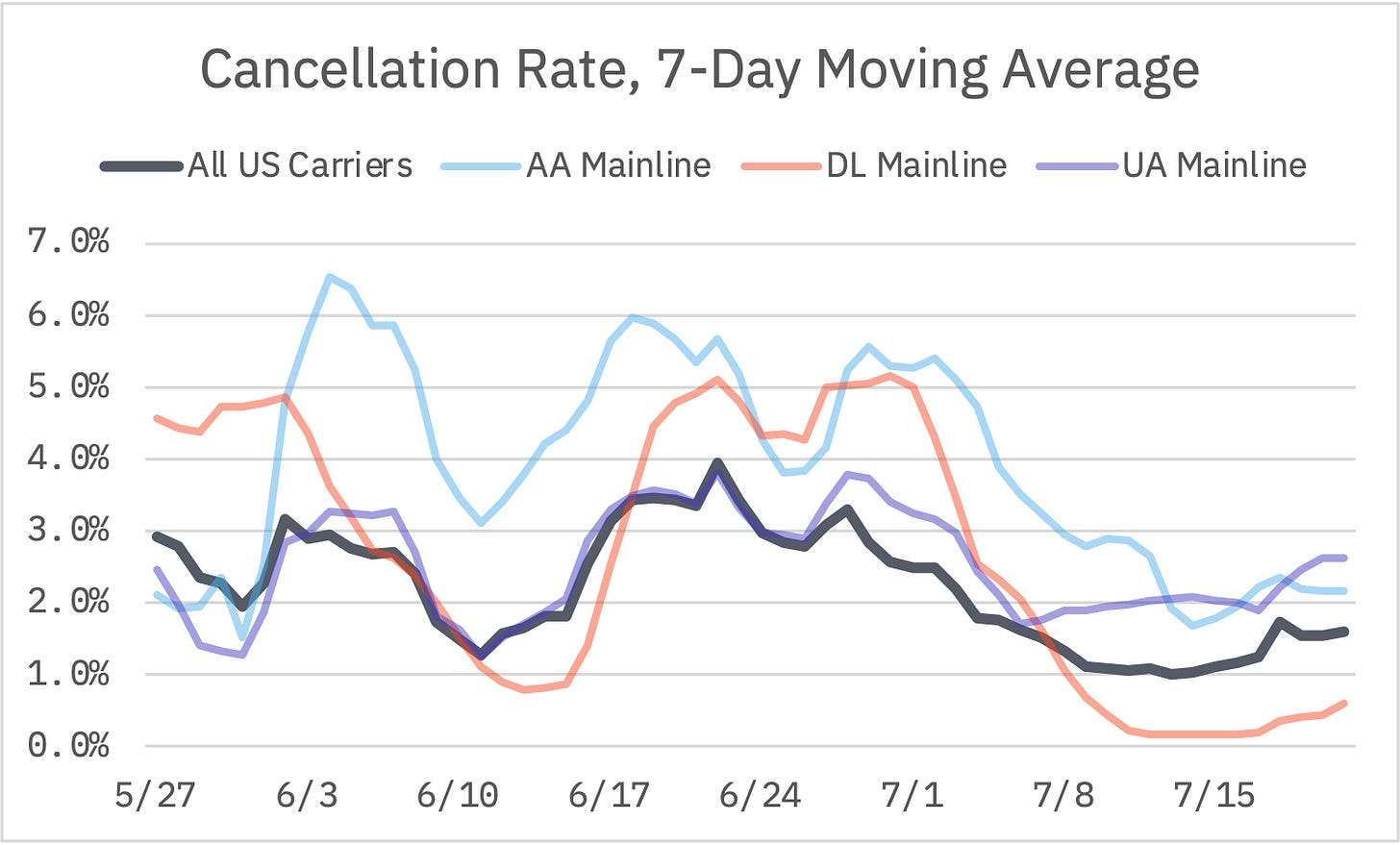

Mercifully, as traveler volumes have trended up, cancellations have done the opposite. From June 16-22, US carries cancelled 3.95% of their scheduled flights; from July 15-21, they managed2 to knock that number down to 1.60%. They even briefly pushed the 7-day moving average underneath 1% (following July 13’s operation). Delta has lead this charge: in the 7 days ended June 30, they cancelled more than 1 out of every 20 mainline flights. For the 7 days ended July 21, it’s more like 1 in 200. If you’re looking for degradation, you’d have to squint, but could find signs at United. To their credit, they’ve shaved more than a percentage point off their 7-day moving average in the last month. Still, they’ve lost ground relatively speaking—after July 7, Delta could claim a better 7-day mainline cancellation rate and following Tuesday, American was able to do the same.

So with some table-setting done, let’s move onto tomorrow… where our focus will be on a pair of United hubs.

Chicago O’Hare (ORD)

An afternoon respite from storms today is brief, as a very humid airmass will remain in place ahead of an approaching cold front. More thunderstorms are forecast to track into northern Illinois late this evening, bringing potentially damaging winds and heavy rainfall. The question, as it pertains to this outlook, is when will the back edge of the complex clear the O’Hare area (or weaken enough as to lose definition). Though high-resolution guidance has not handle this morning’s storms all that well, it suggests storms will have sagged south of I-80 by mid-morning.

While we love (no, really) pouring through thousands of rows of hourly data, for the sake of deriving some rough probabilities in these posts, sometimes a same-day approach is serviceable. And in the case of tomorrow, today looks to be a pretty good comp in terms of timing. This morning, ORD essentially opened up at a 32 arrival rate, then stepped up to:

a 48-rate at 9 a.m.,

a 68-rate at noon,

an 80-rate at 1 p.m.,

a 100-rate at 2 p.m.,

and finally a 112-rate at 4 p.m.

Though there’s slightly less scheduled demand3 in the earliest hours of tomorrow’s operation than today’s, by mid-morning, a Sunday schedule becomes busier than Saturday. Resultantly, we’ve modeled a 6% increase in delay versus today, when average delays were 118 minutes (so up to 125 minutes4); we’d also expect a more pronounced peak in delay intensity during the 9 a.m. hour (versus today, when delays in the 8, 9 and 10 a.m. hours were roughly equal).

Denver (DEN)

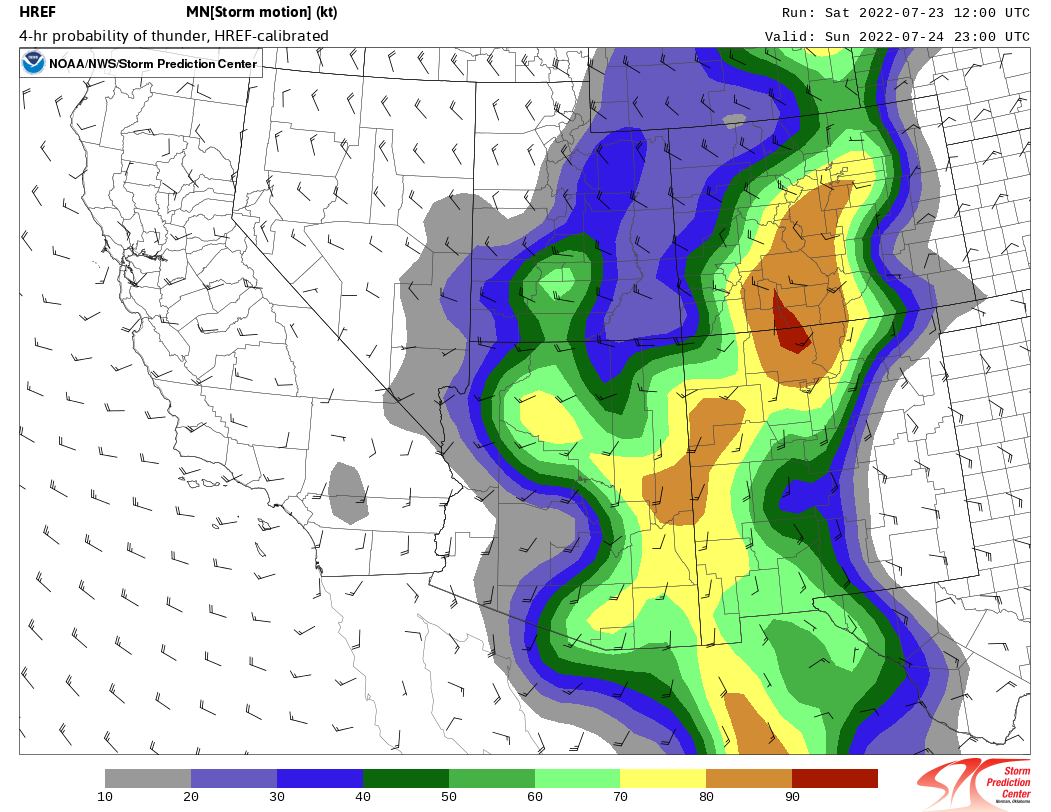

Though instability is skinny5, a weak disturbance crossing Colorado tomorrow evening will [weirdly?] have some subtropical moisture available to it. On the balance, thunderstorms look likely during late afternoon into early evening. Here we’ll return to our spreadsheets: we think there’s a 1 in 10 chance for rates equal to or lower than 32 and an incremental 1 in 4 chance for rates between 33 and 64.

We’ve modeled a 64 arrival rate across the afternoon with two exceptions: a 32-rate during the 5 p.m. hour followed by a 54 rate during the 6 p.m. hour. For scheduled arrivals in the 2 p.m. through 8 p.m. hours, delays average nearly 30 minutes; delays peak around 70 minutes in the 6 p.m. hour.

Recommendations

United has issued a fare difference waiver covering O’Hare tomorrow (and today, for that matter). American, which also operates an O’Hare hub, has not matched. If you’re slated to connect through ORD tomorrow morning on United, we’d suggest you take advantage of this flexibility; this is especially true for any itineraries that originate within 700 miles or so of ORD, as these inbound flights will be most prone to a tactical ground stop.

As of 3 p.m. ET, no fare difference waiver has been published for Denver (from United or Southwest), though probabilities for thunder are actually higher at DEN than ORD. That said, delay intensities do look to be lower for DEN tomorrow, so it’s a defensible decision from the airlines. Nonetheless, if you have a late day layover in DEN that can’t absorb a delay of at least 30 minutes, we’d encourage you to check for alternate routings. In these cases, we’ll take the opportunity to remind readers that airlines have meaningfully improved general rebooking flexibility by eliminating change fees for most tickets (though the fare difference may still apply). We’ve linked to the same-day change policy for United and Southwest.

Finally, we’ll highlight the NYC area. The cold front—and associated thunderstorms—that cross the Chicago area in the morning will propagate east, reaching central New York State by late day. This convective activity is forecast to weaken as it approaches the area, though may still present routing issues depending on timing. Separately, an isolated thunderstorm is possible for the terminal areas during late afternoon along a sea breeze boundary.

Gross. Get your mind out of the gutter.

We attempted to understand how much was attributable to airlines better managing day-to-day operations vs. more favorable capacity and demand dynamics, however ASPM unbelievably reported the same efficiency AAR for core 30 airport for each of the last 11 days.

Cargo airlines as well as private jets are not included in scheduled demand and only become apparent when they file a flight plan (generally day-of). This unforeseen demand introduces the risk that delay probabilities/intensities are under-forecast. From June 22 to July 22, unscheduled demand has added 9.7% to scheduled demand for Core 30 airports (non-MEM). For ORD and DEN, unscheduled demand added 4.7% and 5.7%, respectively.

While our modeling is aimed at tackling arrival delays, there's a strong correlation to departure delays (albeit with some lag and/or possible alleviation). Consider a scheduled "turn" at an airport: the inbound flight is scheduled to arrive at 2:19 p.m. and departs at 3:30 p.m. (71 minutes of turnaround time). Let's say the inbound is delayed by 40 minutes and instead arrives at 2:59 p.m. We'll further assume that the airline doesn't need the full 71 scheduled minutes to turn the aircraft and can accomplish the turn in 45 minutes if they hustle - the departure will push back from the gate at 3:44 p.m. (delayed by 14 minutes). In this example, a 40 minute arrival delay in the 2 p.m. hour is partially passed through to a departure in the 3 p.m. hour. Had the turnaround been scheduled at 45 minutes instead (i.e. no turnaround buffer), the lag between arrival and departure delay would still exist, however the delay would be fully passed through.

Additionally, our efforts are aimed at diagnosing air traffic delays (i.e. those that result from an imbalance between capacity and demand). Though not the focus of our efforts (yet), delays owing to aircraft servicing, airline staffing, network effects, etc. are always lurking.

Loved that phrase from NWS Boulder.

Instability measures the tendency of a parcel of air to move, especially upwards after being lifted, and is a prerequisite for severe weather. That is to say, there is some limiting influence given marginal instability.