Some predictions and prescriptions for Delta's Atlanta operation on Friday

aka our July 1 disruption outlook

Welcome to our new readers—we're grateful that you're here! We're building deep learning algorithms to democratize flight delay predictions; until we launch, we're eager to synthesize things manually in our outlooks. These feature several recurring themes that we recognize may be unfamiliar or intimidating, so we’ve written explainers that tackle airport arrival rates, queuing delays in the airspace and different tools to distribute those delays. If there’s a topic or mechanism you’d like to see unpacked, please let us know (same goes for special travel occasions).

This popped into your inbox a little earlier than normal, right? It’s not unintentional—with Delta having issued a systemwide fare difference waiver, we wanted to provide as much time as possible to act on any insight herein. Accordingly, to get this sent a little earlier, we’ve narrowed our focus to Atlanta (ATL), which looks to be the riskiest Delta hub on Friday.

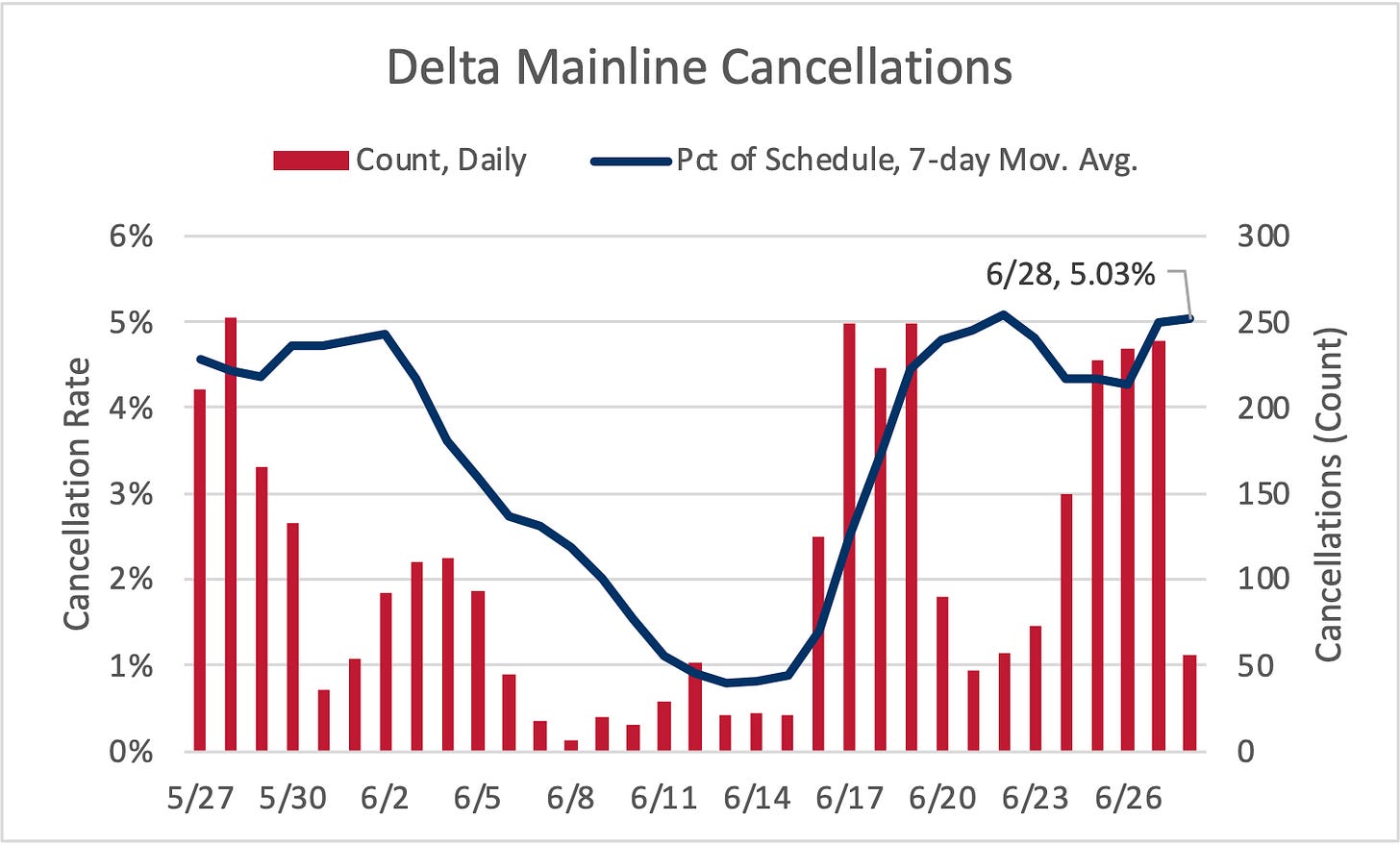

As we wrote last week, Delta’s deterioration has materially contributed to the prevailing dissatisfaction with airlines: About a month into the summer air travel season, their mainline cancellation rates has increased 14x versus1 2019. It looked like Delta might be turning the tide during the back half of last week; even through the weekend they held the line. Then 239 flights were cancelled on Monday; after Tuesday the 7-day moving average was at its second-highest level of the period. And out came the travel waiver, a instrument typically reserved for named storms and applied to relatively narrow geographies. Does Delta assess that this weekend will feature disruption on the level of tropical storm, but geographically unbounded?

And we haven’t even mentioned TSA throughput yet! Used as fodder for these opening paragraphs during the last 6 months, TSA checkpoint volumes finally reached a new high-water mark last Friday—2.455 million travelers were screened, surpassing the 2.451 million from the Sunday after Thanksgiving 2021. That record did not stand for nearly as long as its predecessor, as 2.462 million were screened on Sunday. Our Holt-Winters model is probably a bit off-balance at this point owing to two “regular” weekends sandwiched between 3-day weekends recently. That said, it calls for 2.484 million travelers to be screened nationwide on Friday. Some back-of-the-napkin math using last year (when the holiday was similarly observed on Monday) points to 2.522 million screened.

Alright. Back to ATL. Daytime heating looks to be the hair-trigger for thunderstorm development, given surging tropical moisture. Though the bullseye for convection is progged to be a bit south and east, widespread showers and thunderstorms are still forecast for the ATL area. Problematically, the slow and meandering storm motion will allow for training and downpours.

We think there’s about 1 in 8 chance for an airport arrival rate of 80 (ATL’s optimal rate is 132); scheduled2 airport demand exceeds 80 just once (84, in the 8 a.m. hour). We expect the FAA will take a wait-and-see approach and resolve any demand overage that occurs with a ground stop. Typically, airlines are willing to make the same bet that the FAA enters—if they win, capacity proves sufficient and air traffic delays are not introduced to the system. The losing side of this bet is capacity falls short of demand, in which case the wait-and-see approach scatters delay haphazardly. The alternate bet is the conservative one: Operators proactively adjust demand to fit bearish arrival rate expectations. This pays out if capacity proves insufficient because delays are more intentionally (read: optimally) distributed. Of course, if capacity remains above demand (for tomorrow, we think there’s 7 in 8 chance), delay was unnecessarily introduced to the system.

With their operation teetering, we’re guessing Delta leadership is seeking a more risk-averse posture. If they don’t want to throw their lot in with the FAA and its presumed wait-and-see approach, we wouldn’t be surprised to see a company-only ground delay program. As a matter of fact, they did something similar at LaGuardia (LGA) last Friday. When an airline requests a company-only initiative from the FAA, air traffic controllers will assign EDCTs to flights just the same as a “normal” initiative—but only those flights operated by the requesting carrier (and any regional flights doing business as the mainline parent, i.e. “subs”) will be captured.

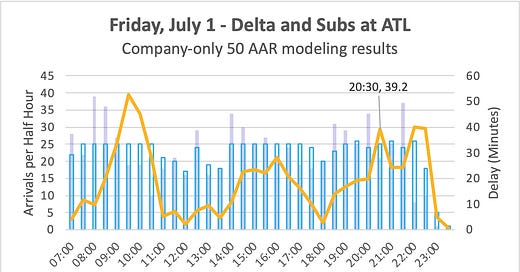

So then the question is what the company arrival rate should be. Delta (the marketing carrier) represents about 77% of ATL’s schedule tomorrow, which conveys a low-end company rate of about 62. Scheduled Delta arrivals would exceed that rate during just 2 hours tomorrow (8 a.m. and 2 p.m.), so it wouldn’t do much to flatten demand. Moreover, airborne holding and diversions (symptoms of thunderstorm-driven routing issues) can result in fewer aircraft actually being handled than the advertised rate indicates. Should Delta wish to hedge this risk as well, we think something like a company arrival rate of 50 would be appropriate.

We modeled an all-day 50 rate for Delta (the marketing carrier), which produces an average delay of 15 minutes3 across the day. Two caveats: morning delays may be unreasonably pessimistic, given that daytime heating will provide the spark only later in the day. And, two, any cancellations (Delta has scrubbed just 6 mainline flights Friday, as of noon ET) would reduce demand and therefore delays.

If we were Delta, we’d undertake a similar modeling exercise and begin to step into the solution as soon as possible, i.e. publish some afternoon and evening delays even before EDCTs are issued. This would provide the opportunity for disrupted passengers to rebook with a fuller set of options, airport staff planners to build more realistic assignments and maybe even crew scheduling to reset a couple pilot duty clocks. If we were a traveler holding a Delta ticket and the itinerary calls for an afternoon or evening layover in ATL, we’d search for an itinerary that uses a different connecting hub. In such a case, the waiver mentioned at the top of this post will allow for the change to be made at no cost.

Unfortunately, disruption doesn’t figure to be confined to just ATL. An area of weak low pressure churning over the Gulf is given a 40% chance to develop into a tropical cyclone; regardless of development, excessive rainfall is possible for Houston (IAH). To the north, an advancing cold front swings a line of broken thunderstorms across Chicago (ORD) during the midday before creating possible routing issues for NYC airports during the late day. And finally, anomalous moisture and ample instability should combine to produce active weather for the Denver (DEN) area. We’ll try to tackle a couple of these airport on Twitter later today.

For 5/27/22-6/28/22 vs 5/24/19-6/25/19.

Cargo airlines as well as private jets are not included in scheduled demand and only become apparent when they file a flight plan (generally day-of). This unforeseen demand introduces the risk that delay probabilities/intensities are under-forecast. From May 31-Jun 29, unscheduled demand added 2.47% to scheduled demand at ATL.

While our modeling is aimed at tackling arrival delays, there's a strong correlation to departure delays (albeit with some lag and/or possible alleviation). Consider a scheduled "turn" at an airport: the inbound flight is scheduled to arrive at 2:19 p.m. and departs at 3:30 p.m. (71 minutes of turnaround time). Let's say the inbound is delayed by 40 minutes and instead arrives at 2:59 p.m. We'll further assume that the airline doesn't need the full 71 scheduled minutes to turn the aircraft and can accomplish the turn in 45 minutes if they hustle - the departure will push back from the gate at 3:44 p.m. (delayed by 14 minutes). In this example, a 40 minute arrival delay in the 2 p.m. hour is partially passed through to a departure in the 3 p.m. hour. Had the turnaround been scheduled at 45 minutes instead (i.e. no turnaround buffer), the lag between arrival and departure delay would still exist, however the delay would be fully passed through.

Additionally, our efforts are aimed at diagnosing air traffic delays (i.e. those that result from an imbalance between capacity and demand). Though not the focus of our efforts (yet), delays owing to aircraft servicing, airline staffing, network effects, etc. are always lurking.

Excellent analysis. The question of how conservative to go is an old conundrum. While unnecessary delay may be generated, the clear advantage is that the delay is manageable by the airline. There were some studies regarding total delay/disruption of “roll the dice” vs crank it down proactively.

With the pilots and F/As picketing this week, I wonder if the company anticipates some sort of work action over the weekend, and the waiver is just a preemptive strike (no pun intended)?