Update: MLK weekend go travel

A sharp snowfall gradient makes for an awkward MSP forecast; we're hoping snow holds out in DEN; plus some level-setting on recent trends.

Welcome to any new readers — we're grateful that you're here! We're building deep learning algorithms to democratize flight delay predictions; until we launch, we're eager to synthesize things manually in our outlooks. These feature several recurring themes that we recognize may be unfamiliar or intimidating, so we’ve written explainers that tackle airport arrival rates, queuing delays in the airspace and different tools to distribute those delays. If there’s a topic or mechanism you’d like to see unpacked, please let us know (same goes for special travel occasions).

The TSA screened 1.23 million travelers yesterday, equal to 64.3% of throughput from Monday, Jan. 3 and firmly within our prediction interval. Our confidence is increasing that we’ll see at least 1.69 million travelers screened on Friday (our lower bound from yesterday’s first look) and we’ll actually nudge our upper bound up to 1.76 million. Wherever actual checkpoint numbers come in, we’ll reiterate our warning from yesterday for those travelers (and those making plans dependent on their arrival):

We typically offer a disclaimer that our efforts are aimed at diagnosing air traffic delays (i.e. those that result from an imbalance between capacity and demand) and that delays owing to aircraft servicing, airline staffing, network effects, etc. are always lurking—more so than any other outlook we’ve written, travelers would do well to adjust their expectations for pervasive non-air traffic delay.

We obviously believe the theme remains broadly applicable—with sick calls approaching 1/3 of planned staffing levels in some cases1, sluggishness seems likely to prevail—though we could still afford to level-set on more recent trends.

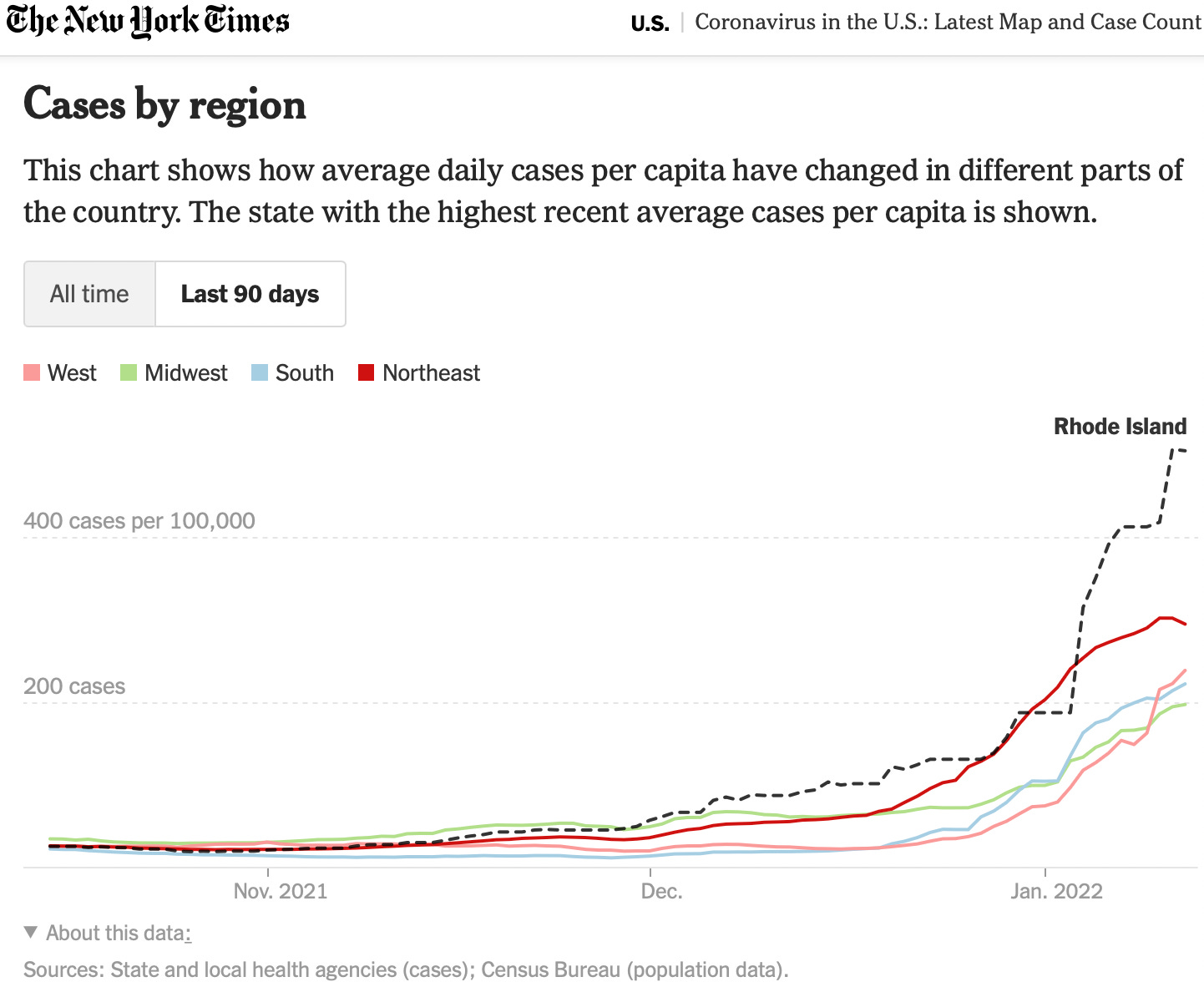

When we’d written our Jan. 7 post examining holiday cancellations through the lens of geography, the Northeast had opened up a considerable gap over other regions in terms of daily cases per capita and the West benefited from the lowest incidence. We had speculated at the time that Omicron’s initial path had materially disadvantaged JetBlue (45% of block hours departed from the Northeast) while affording a degree of protection to Southwest (just 5%). Fast forward one week, and the Northeast appears to have crested this wave while the West has jumped the Midwest and South. We hope JetBlue is seeing signs that they’re on the backside of their sick call peak, but we’d wager staffing pressures continue to increase at Alaska (73% of block hours depart from the West), regional carrier SkyWest (52%), Southwest (38%) and to a lesser extent, United (31%).

Meanwhile, many carriers took the step of removing flights from selling schedules during an update this past weekend, which—among other reliability benefits—should relax the leverage exerted by pilot populations. We updated our calculations of pilot utilization in a Jan. 10 post, wherein we estimated Alaska, Skywest and United2 notably reduced utilization by at least 2.25%. Southwest, on the other hand, remained not only unchanged, but relatively highly leveraged, with the second highest utilization. The good news is cancellations have generally trended down in the last week, with most carriers having cancelled 6% or less of their schedule yesterday (regional airline Mesa excepted, who might not be fully benefiting from their block hour reductions yet).

With some table-setting accomplished, let’s pick up where we left off yesterday and refresh our predictions for DEN, MSP and BOS.

Denver (DEN)

Models continue to show an elongated area of low pressure and associated cold front moving across Friday, though have added a second, cut-off area of low pressure as well. Models are also indicating more moisture will be available than previously forecast. Despite better moisture, accumulations still don’t look to exceed 1”. The bigger question is when will snow arrive—unfortunately, even with a more granular forecast in hand, the 10 a.m. hour (when scheduled arrival demand3 peaks at 84) remains a closer call than we’d like. The TAF4 calls for snow to start at 11:00 a.m., with ceilings and visibility lowering accordingly; high-resolution ensemble guidance also keeps chances for precipitation below 10% at 10:00 a.m. Still, we’re going to bump our arrival rate floor down to 64 (and bump up our chances for equal or lower rates to 15%). If the forecast stays mostly intact, we’d expect the FAA will take a wait-and-see approach tomorrow: optimism that they could land the 10 a.m. hour before conditions deteriorate would not be unfounded.

If, however, conditions deteriorate a bit earlier than forecast, that would leave just a first-tier5 ground stop for them to reach for. We’ve modeled average delays of 70 minutes for captured6 flights in this case. A 64 rate would also bring delays into play for arrivals in the 4 p.m. hour (70 scheduled) and 6 p.m. hour (when demand is heavily front-loaded). We wouldn’t be surprised to see another first-tier ground stop in the 4 p.m. hour (delays for captured flights would average 23 minutes), but we’d bet metering and/or miles-in-trail (MIT) could handle the potential overage in the 6 p.m. hour. Deicing delays for departures should also be expected whenever snow is actively falling (also the case for MSP and BOS). As we wrote last night, unfortunately deicing introduces one more process that needs to be staffed, which is a precarious proposition at the moment.

Minneapolis-St. Paul (MSP)

A winter weather advisory has been hoisted for MSP, however a winter weather warning has been reserved for points west. The Twin Cities awkwardly straddle a sharp snow total gradient, resulting in unusually high uncertainty for this close-in. Ensemble guidance seems to agree on a mean of 2-4”, however there appears to be at least a 30-40% chance for greater than 4”. Importantly, the TAF includes chances for moderate snow between 8 a.m. and 2 p.m., which may prompt runway closures for snow removal at less than ideal times.

Like DEN, we unfortunately think it’s appropriate to revise MSP’s arrival rate floor down to 24 (at least a 1 in 8 chance). Also like DEN, it’s somewhat borderline whether the peak demand period is impacted by the lowest airport capacities, as demand is tallest in the 2 p.m. hour (41 scheduled arrivals). We’re less sure about what tool the FAA reaches for, as they’ll be emerging from the worst conditions, rather than hoping it holds out. If moderate snow lingers for an hour longer than forecast (or it takes airport plowing teams an hour to get back on track after moderate snow ends), a 24 arrival rate in the 2 p.m. hour would not be disastrous, provided they can step up to something like a 54 arrival rate by 3 p.m. In such a case, delays would average 16 minutes in the 2 p.m. hour (across all arrivals) but taper off during the 3 p.m. hour. If, however, a 24 arrival rate persists through the evening (perhaps the airport is unable to staff a full complement of plows), average delays would continue to climb through the 8 p.m. hour, when they would reach an average of 86 minutes. This latter scenario would also introduce the possibility of cancellations to mitigate average delays.

Boston (BOS)

Deepening low pressure is still expected to remain well offshore, making its closest pass during Friday afternoon/evening before lifting into Nova Scotia. Snow looks to mix in from the start of precipitation, however agreement has improved around snow totals (generally less than 1”). Here we’ll raise our arrival rate floor to 32 (1 in 10 chance for equal or lower rates), though, if realized, we think more uniform demand would dictate use of a ground delay program (rather than ground stop). We’ve modeled an all-scope GDP with delays starting in the 4 p.m. hour, peaking around 27 minutes in the 5 p.m. hour, and lingering until the 8 p.m. hour. Later operations in BOS may be further hampered by possible flash freeze conditions as well as gusts conceivably reaching 35 knots.

Recommendations

As of 6:00 p.m. ET, Southwest is the only airline to have issued a waiver for winter weather in the Midwest (it covers DSM, MCI, MSP, OMA, STL). In the absence of waivers, we’ve linked to the same-day change policies for Delta (who operates hubs in MSP and BOS) as well as United (DEN). Mercifully, airlines have meaningfully improved rebooking flexibility by eliminating change fees for most tickets (though a fare difference may still apply). There’s a few itinerary features that give us pause and for which we’d encourage itinerary holders consider taking advantage of that improved flexibility:

A layover in DEN around 11 a.m., if originating from within 700 miles or so

A layover in MSP around 3 p.m., if the scheduled connection time is less than 45 minutes

A late afternoon or evening layover in BOS, if scheduled connection time is less than 60 minutes.

We’ll be up on Twitter tomorrow to share any last minute insights. Otherwise, we’re turning our attention to possible icing for ATL and CLT—as well as heavy snow for the Mid Atlantic and Northeast—that threatens to disrupt return travel. Notably, Delta has already issued a weather waiver for this Southeast winter weather. We’re also keeping an eye on this weekend’s selling schedule update for further block reductions.

In a note to employees on Jan. 10, United CEO Scott Kirby wrote, “Just as an example, in one day alone at Newark, nearly one-third of our workforce called out sick.”

Mainline Alaska and United. American, Delta, United and Alaska operate their own flights, considered their Mainline operation (on larger jets, with upwards of 100 seats). These airlines also “purchase capacity” from regional carriers (e.g. SkyWest), wherein the regional carrier operates smaller aircraft (i.e. less than 100 seats) under the Mainline brand.

Cargo airlines as well as private jets are not included in scheduled demand and only become apparent when they file a flight plan (generally day-of). This unforeseen demand introduces the risk that delays are under-forecast. Unscheduled demand added 2.4% to scheduled demand for Core 30 airports between 1/4/2022-1/12/2022. For the airports we’ll consider today, only MSP (6.6%) is above average in this regard.

Terminal aerodrome forecast (TAF) is a format for reporting weather forecast information, particularly as it relates to aviation. TAFs are issued at least four times a day, every six hours, for major civil airfields: 0000, 0600, 1200 and 1800 UTC, and generally apply to a 24- or 30-hour period, and an area within approximately five statute miles from the center of an airport runway complex.

TAFs complement and use similar encoding to METAR reports. They are produced by a human forecaster based on the ground. TAFs can be more accurate than Numerical Weather Forecasts, since they take into account local, small-scale, geographic effects. Source: Wikipedia

A first-tier ground stop distributes delays disproportionately to those flights originating from within 700 miles or so.

While our modeling is aimed at tackling arrival delays, there's a strong correlation to departure delays (albeit with some lag and/or possible alleviation). Consider a scheduled "turn" at an airport: the inbound flight is scheduled to arrive at 2:19 p.m. and departs at 3:30 p.m. (71 minutes of turnaround time). Let's say the inbound is delayed by 40 minutes and instead arrives at 2:59 p.m. We'll further assume that the airline doesn't need the full 71 scheduled minutes to turn the aircraft and can accomplish the turn in 45 minutes if they hustle - the departure will push back from the gate at 3:44 p.m. (delayed by 14 minutes). In this example, a 40 minute arrival delay in the 2 p.m. hour is partially passed through to a departure in the 3 p.m. hour. Had the turnaround been scheduled at 45 minutes instead (i.e. no turnaround buffer), the lag between arrival and departure delay would still exist, however the delay would be fully passed through.